“Last week, the launch of the Conservative and Labour manifestos finally made an official commitment to maintain the state pension Triple Lock for the next five years. As a result, state pensioners can have peace of mind knowing that their state pension will continue to increase at the highest of price inflation, earnings growth or 2.5%.

“The Conservatives went a stage further, committing to their new ‘Triple Lock Plus’, under which the personal allowance for state pensioners would also increase in line with the Triple Lock. This removes any possibility of state pensioners in receipt of the full new state pension paying income tax on this.

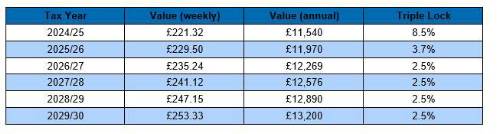

“The Conservatives also set out what the Triple Lock would produce “on current forecasts”. For next April, they predict a £430 increase from £11,540 to £11,970, equal to 3.7%. Given today’s announcement that inflation sat at 2.0% for May, it’s very likely the Triple Lock will be based on earnings growth. This currently stands at 5.9%, but it’s the figure published in September which is used, and the implied manifesto expectation is this will fall to 3.7% by then.

“The Conservatives also predict the state pension will have risen to £13,200 in 5 years’ time, come 2029/30. While not specified in their manifesto, Aegon calculations show that this means they are assuming the minimum 2.5% increase in the following 4 years. In other words, current forecasts are that both inflation and earnings growth will not exceed the 2.5% per year guaranteed increase over this period.

“On that basis, the full state pension would equal £11,970 in April 2025, £12,269 in April 2026, £12,576 in April 2027, and £12,890 in April 2028, before reaching the £13,200 in April 2029.

“These figures are based on the assumption that inflation will remain at or below 2.5% throughout this period. And while the increases are far below the bumper boosts of 10.1% and 8.7% in April 2023 and 2024 respectively, when inflation and earnings growth were skyrocketing due to exceptional circumstances, this return to more typical Triple Lock increases will still allow state pensioners to at least retain their purchasing power.”

|