New analysis from the UK’s leading insurance premium finance company, Premium Credit, shows the Construction sector borrows the most to fund insurance but the Professional and Scientific sector is the fastest-growing.

Premium Credit’s Insurance Index2 found more than half (51%) of SMEs are relying on some form of credit to fund their insurance with the average firm borrowing an average £1,130. However around 13% of SMEs who use credit to pay for their insurance claim to have borrowed over £3,000 to fund their cover.

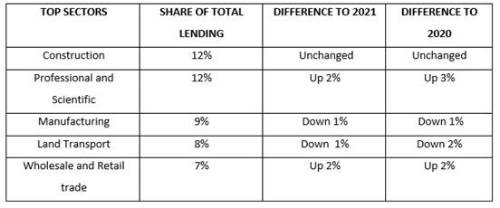

Construction firms were the most likely to use credit – they accounted for 12% of all net advances from Premium Credit last year. That was unchanged on 2021 and 2020.

The Professional and Scientific sector accounted for 12% of net advances last year compared with 10% the previous year and 9% in 2020. Other sectors in the top five were Manufacturing, Land Transport and Wholesale and Retail Trade.

Premium Credit’s Insurance Index, which monitors insurance buying and how it is financed, found that 25% of SMEs have reduced the level of cover they have across a range of insurance with vehicle, property and public and product liability most likely to see reductions in cover. Around a third (32%) of SMEs which have reduced the level of cover cancelled at least one policy. Up to 10% questioned said they plan to increase the level of cover in the year ahead.

The table below shows the top five sectors for share of total lending to buy credit and how that has changed.

Owen Thomas, Chief Sales Officer at Premium Credit commented: “Insurance is vital for business operations as demonstrated by the near 20% growth in net advances we have seen year on year. It is particularly important in the construction sector which accounts for how much lending we do in the sector.”

|