However, consumers appeared less likely to want to move to those companies in 2022 than in previous years, observes GlobalData, a leading data and analytics company.

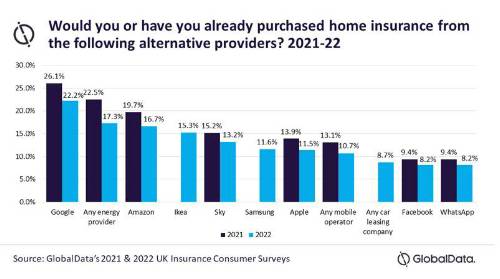

GlobalData’s 2022 UK Insurance Consumer Survey* found that across the eight companies (or types of companies) we asked about, all eight saw declines in consumer interest in 2022 compared to 2021. Google remains the preferred alternate home insurance provider for consumers, but even it saw a decline in interest from 26.1% to 22.2%. The largest drop-off was ‘any energy provider’ which saw a 5.2pp decline, though it remains in second place.

It is likely that huge increases in energy prices have reduced consumer trust in these companies. Though it has more of a presence in the home and home emergency markets than other players listed, with British Gas a market leader in home emergency insurance. This is likely to be why it remains in second place.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, comments: “Although reduced consumer interest in these alternative providers is clear, it still remains a significant threat to the home insurance industry. The greatest threat across the industry as a whole may be embedded insurance. While it is less of a threat within home insurance specifically, product manufacturers (such as mobile providers or car manufacturers) offering insurance at the point of sale offers convenience to customers, so it is a growing trend to watch.”

After being rumoured for many years, Amazon launched its Amazon Insurance Store in October 2022. It has a wide range of smart technology products, such as Amazon Echo, which already gives it a strong presence within UK households. Similarly, Sky bought smart home technology provider Neos in 2021 and then moved into the home insurance market in December 2022.

Carey-Evans concludes: “Therefore, a slight reduction in consumer interest does not mean the threat from big technology providers is waning, as recent developments suggest the opposite is happening. Insurers will be buoyed by what appears to be reduced consumer trust for these potential rivals. However, they will need to ensure they can provide a strong digital offering, as that will be guaranteed from any of these potential threats.”

* GlobalData’s 2022 UK Insurance Consumer Survey was conducted in Q3 2022 and had 4,017 respondents.

|