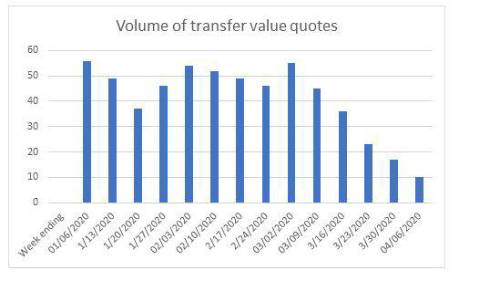

Based on a sample of around eighty DB pension schemes administered by LCP, the chart shows the weekly number of requests for DB transfer values. In January and February, a typical week saw 40-50 scheme members request a transfer value, but that number has been falling steadily since the start of March with volumes now down by more than three quarters.

Possible explanations for the most recent decline in requests for transfer values include:

The major disruptions to everyday life from the lockdown meaning that members have, at least temporarily, more pressing things to think about

Members attaching more weight to the relative certainty of a Defined Benefit pension compared with a Defined Contribution pension, particularly in light of recent stock market slumps;

Disruption to the work of IFAs which might have otherwise led to inquiries about transfer values

A significant number of DB schemes have now decided to put a temporary hold on providing transfer quotations to allow market volatility to settle down and give time to review their transfer value calculation bases in light of the latest developments. This is likely to reduce overall transfer activity further for a period of time.

However, there are a few schemes where, in stark contrast, the pace of requests has held up (and for some even increased a little).

These appear to be associated with situations where there may be particular concern amongst members about the financial strength of the employer in this crisis. In these cases in particular scheme trustees and their administrators will need to watch out closely in the coming weeks for scammer activity.

Commenting on the trends, Bart Huby, partner at LCP said: “Regulators are understandably concerned about the risk of people under financial pressure transferring money out of their pensions and being exposed to scams. But our data suggests that in the short term there has been a sharp drop in the number of people asking for information about transferring out of their salary-related company pension. This could reflect nervousness about market conditions or simply the fact that people have other things to focus on at the moment. What is not yet clear is whether transfer volumes will bounce back later in the year as schemes relax temporary restrictions on processing transfers and more members decide that they need to access their pensions to meet financial pressures”.

|