By Richard Carter, Fixed Interest Specialist, Quilter By Richard Carter, Fixed Interest Specialist, Quilter

Why were corporate bonds so strong in 2012?

Corporate bonds performed extremely well last year because of demand from yield-hungry investors. The current environment of slow, but positive growth and artificially depressed government bond yields has been a perfect backdrop for the sector. The fact that most companies are in good shape with low amounts of leverage has helped while reduced tensions in the eurozone have provided support for bank debt.

UK corporate bonds rallied by about 15% in 2012 while the overall yield has declined from 5.4% at the end of 2011 to 3.8% at the end of November 2012. Spreads to gilts have compressed by roughly 140bps. Global corporate bonds have also fared well with the US market returning about 10.5% and Europe up by over 12%, in sterling hedged terms.

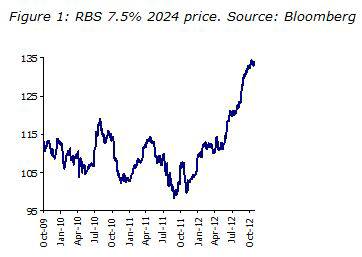

As an example of how strong certain parts of the market performed in 2012, Figure 1 shows the price of the RBS 7.5% 2024 bond, which is an A-rated senior bond. The yield has gone from around 7% at the start of the year to around 3.8% today (despite the credit rating of RBS being downgraded this year by Moody’s).

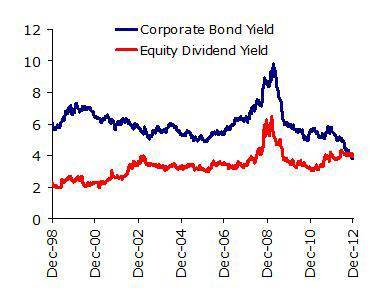

Is there much value left after the rally? (Figure 2)

Overall yields on the index are now at all-time lows, so it is pretty hard to get excited. Indeed, it is worth pointing out that 2012's rally follows on the heels of a pretty good performance in 2011, especially for the non-financial part of the market.

Relative to gilts and other government bonds, there is still decent value in corporate bonds with spreads of just over 2%. Pre-crisis, spreads were as low as 1% for some time although it is hard to see them returning to such low levels. For cautious investors looking for some reasonably low risk income, corporate bonds may still be a worthwhile investment.

Relative to equities though, the sector is beginning to look expensive. Over the last 10 years, the yield on corporate bonds has typically been around double the dividend yield on equities, as measured by the FTSE 100. That premium evaporated last year and the yield on both asset classes is now about the same. While equities are subject to more volatility, they do at least offer some opportunity for capital and income growth, unlike most corporate bonds.

What is the outlook for 2013?

The best case scenario for corporate bonds is a continuation of the current environment – low but positive growth, a muddle-through in the eurozone and ultra-low interest rates. Another year of double-digit returns is unlikely, but between 5 and 7% may be achievable.

However, there are a number of different economic scenarios for this year which could lead to negative returns. An improved outlook for economic growth, perhaps emanating out of the US or the Far East, could lead to a re-appraisal of ultra low yields in fixed income, although it would be likely to boost equity markets.

Alternative scenarios include a rise in tensions in the eurozone which would be bad news for the financials part of the market, as well as a growth shock in the US caused by a failure to resolve the fiscal cliff issue. Other worries include a pick up in inflation or a loss of the UK safe haven status, although that is unlikely to hit global corporate bonds much.

There has been much coverage recently on the lack of liquidity in corporate bond markets. Trading has become more difficult since the global financial crisis with the change in investment bank business models. A lot of money has flowed into very large corporate bond funds which could struggle to meet demand for cash if investors start heading for the exits en masse. These fears may be slightly overblown and many funds have a decent buffer of cash and liquid assets such as government bonds and supranationals. However, it is another reason to be cautious on the sector after such a strong run.

What are the alternatives to corporate bonds?

On a long-term view, the best alternative looks to be equity markets, but within Fixed Income, there is not a great deal of value, especially for cautious investors with government bonds at such expensive levels. High yield and emerging market debt have also been strong and have yields at close to all-time lows, although there is still a long-term investment case for emerging market debt.

Two alternative areas that might be of interest are absolute return bond funds and global sovereigns. Absolute return funds tend to be low duration with diversified sources of performance and should be able to protect capital if yields begin to rise, although they rely heavily on manager skill.

Global sovereign funds tend to do well when sterling is weak and there are good reasons to be bearish, including the challenged state of our finances, the risk of a credit rating downgrade and the fact that our current account deficit is the largest since the early 90s. The drawback is that most government bond yields in other countries are also very low, although the inclusion of certain emerging market countries can help.

As we head into 2013, corporate bonds are still very relevant for investors looking for a reasonable income without too much risk. However, they are unlikely to enjoy the double-digit returns that they have had this year and for investors hoping for some capital appreciation, it is time to consider the alternatives.

Figure 2: UK corporate bonds yield to maturity versus FTSE 100 dividend yield (Source: Bloomberg)

|