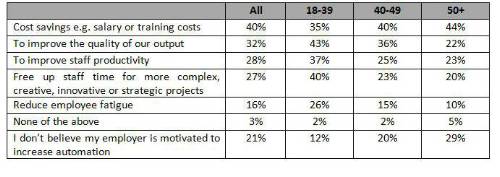

Improving working conditions is considered to be less of a driver, with only 27% of employees believing their employer’s primary motivation for increasing automation is to free up more time for more complex and creative tasks, while even fewer believe it is to reduce employee fatigue (16%). This suggests employees believe automation is being introduced in their workplace to benefit their business rather than employee wellbeing.

Older workers are particularly likely to believe automation is driven by business rather than employee benefits, with 44% of those aged 50 and above claiming cost savings are the main motivation compared to 35% of 18-39s. Younger employees are more inclined to believe automation is being increased to free up staff time for more innovative or strategic projects, with 40% of 18-39s claiming this compared to just 20% of over 50s.

Table 1: What do you believe is your employer’s main motive for increasing automation in the workplace?

Resolving the automation image problem

Employers who wish to convey the benefits of automation for both their staff and business performance should consider how it is being implemented within their organisation.

Nearly half (47%) of all workers say training programmes to upskill existing staff would improve the implementation of automation in the workplace, followed by clear communication and reassurances of job security from their employer (39%) and wellbeing support to address any concerns (28%).

The impact of automation on employer attitudes to staff wellbeing

Half (53%) of employees expect automation to impact their employer’s attitudes to employee health and wellbeing. This includes 28% who believe their employer will become less focused on human wellbeing as automation increases, rising dramatically to 40% of workers aged 18-39.

However, 25% believe automation will free up time for their employer to become more aware or able to focus on staff wellbeing.

An additional one in five (18%) say their employer does not prioritise employee health and wellbeing and they do not expect this to change as automation increases. Therefore, there is a clear need for employers to both maintain and improve wellbeing messages as automation becomes more widespread in the workplace.

Paul Avis, Marketing Director, Canada Life Group Insurance, comments: “Automation has the potential to benefit employees, taking away tedious or repetitive tasks and freeing up time for more enjoyable pursuits, creating a more satisfying working life. However, it’s clear from our research that workers do not think employers have these benefits front of mind, instead increasing automation to primarily benefit the business and meet commercial objectives. As automation becomes more commonplace, employers must ensure they communicate their focus on improving staff conditions, as well as enhancing the business.

“There is a fear that automation will chip away at employers’ attention to employee health and wellbeing, with more ‘human’ concerns pushed aside as the presence of technology grows. The implementation of automation itself can create anxiety and other mental health concerns, while other health and wellbeing issues remain prevalent.

“It has never been more important for employers to maintain focus on health and wellbeing, providing health benefits and support services, such as Employee Assistance Programmes, wherever possible. This lets staff know their employer still prioritises their wellbeing and values them as a member of staff – which can only result in improved engagement and productivity.”

|