Among property types, premiums for ground floor flats (42%), detached bungalows (38%), detached houses (34%), and mid-level floor flats (34%) rose most significantly.

The cost of insuring properties that have previously been flooded jumped by more than a quarter (27%) year-on-year and by almost a third for homes located near bodies of water (31%).

Regions

Home insurance premiums have increased most significantly in Northern Ireland, rising by 62% from £268 in the second quarter of 2023, to £433 this year, the highest in the UK. Yorkshire and the Humber has the second highest premiums at £387, but prices have risen at a relatively slower annual rate of 25%.

Homeowners in Greater London experienced the second-largest jump in insurance premiums after Northern Ireland. The cost of home insurance climbed by 39%, from £262 between April and June in 2023, to £363 during the same period in 2024. Home insurance premiums are at their third highest in Greater London, behind Northern Ireland and Yorkshire and the Humber.

The South East has seen the third most significant jump, with premiums increasing by over a third (36%) from £185 to £251. Considerable increases have also been seen in East Anglia (35%) and Scotland (35%).

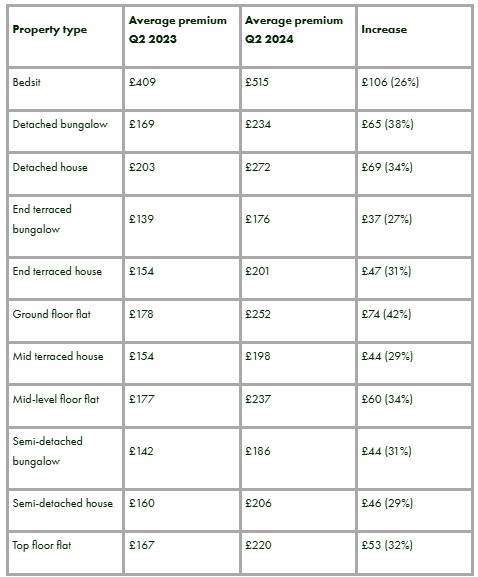

Property type

The cost of insuring ground floor flats increased the most significantly of any property type with premiums climbing by 42% from £178 to £252.

Insurance premiums rose by 38% to £234 from £169 for detached bungalows, the second-largest increase. This was followed by detached houses and mid-level floor flats, both of which saw increases of 34% from £203 to £272 for the former, and £177 to £237 for the latter.

Insurance premiums were highest for bedsits at £515 on average, although premiums for this property type have been rising at a relatively slower rate of 26%.

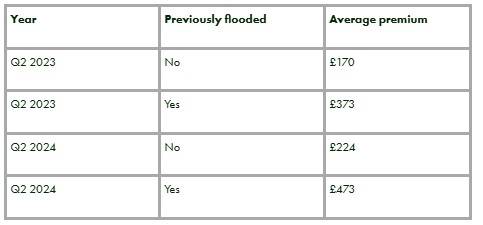

Wet weather

The cost of insuring a property that has been previously flooded increased by 27% from £373 in the second quarter of last year to £473 this year. Similarly, the price of home insurance for homes located near bodies of water rose by nearly a third (31%) from £180 to £235. The difference between insuring a property that has previously flooded and one that has not has also increased year-on-year, from £203 to £249, a jump of almost a quarter (23%).

If you live in an area with a greater risk of flooding, you may likely face a higher home insurance premium as insurers view your home as riskier to insure. Some homeowners in a flood-risk area could even find it difficult to find an insurance provider willing to offer them a policy at all. Joint initiatives involving the government and the insurance industry like Flood Re can provide homeowners in this situation with access to affordable home contents and buildings cover, ensuring they are not left financially exposed to the prospect of extreme weather.

Helen Phipps, Director at Compare the Market, commented: “Home insurance premiums have continued to rise between April and June this year, with the increases likely to put pressure on many homeowners already contending with a host of other rising costs. Many different factors could in part be influencing the price of home insurance, such as the cost of rebuilding a home and the wet weather that the UK faced in Spring 2024. We would encourage homeowners to compare different policies online to see which deals are available and right for your circumstances.”

|