Aegon and NextWealth launch the fifth edition of their retirement advice report Managing Lifetime Wealth: retirement planning in the UK. The report offers a comprehensive view of the state of the retirement advice market, complemented this year with findings amongst advised clients.

The report maps how the industry has changed, and in some areas remained the same, across recent years, helping to understand the impact of regulatory changes as well as events such as COVID-19 and the cost-of-living crisis.

Demand

Against the backdrop of market declines and economic crises, the new data establishes that retirement advice has remained a hugely important part of the financial advice industry, with demand growing in the past year.

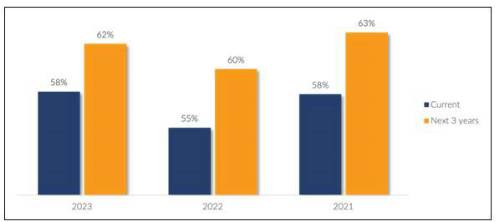

Advisers estimate that well over half (58%) of the assets they advise on are for clients receiving retirement advice, an increase from 55% the previous year. They expect this to continue to rise, reaching 62% over the course of the next three years.

This positive view of the significance of retirement advice has been consistent throughout the five years of the study.

Aegon and NextWealth, Managing Lifetime Wealth, Q. What percentage of the assets you advise on personally are for clients receiving retirement advice? And Q. Looking ahead 3 years, what percentage of the assets you advise on personally will be for clients receiving retirement advice? N=221/212/212 advisers

Drivers

In last year’s report, we saw that changing attitudes to work were driving demand for retirement advice, as clients reassessed their priorities during the pandemic, with a marked increase in clients retiring early.

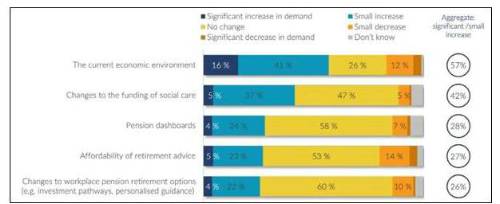

This year, advisers have attributed demand to uncertainty and volatility in the market. 57% of advisers expect the current economic environment to increase demand for retirement advice. Advised clients’ views are in line with this: three quarters (75%) say that the economic situation of the past year has led them to consider changing their level of risk, the income they take or review how much and/or when they pass on money.

Changes to the funding of social care is seen as the second biggest driver of demand for retirement advice according to advisers (42%). Although the research was carried out prior to the delay to the new social care funding deal, it demonstrates a key area of opportunity for advisers.** This is especially true as 58% of clients have either taken advice on this or are interested in doing so.

However, only 44% of advisers currently offer advice here.

Aegon and NextWealth, Managing Lifetime Wealth, Q. How do you see the following developments changing the demand for retirement advice? N=221 advisers

Ronnie Taylor, Chief Distribution Officer at Aegon, comments: “After a tumultuous time over the past year, with volatility in the markets and regulatory change, retirement advice has remained a vital element of the financial advice industry. It’s positive to see that sentiment amongst advisers around the retirement advice part of their businesses has lifted too.

“The research shows that the cost-of-living crisis plays a huge part in client demand for retirement advice, which is perhaps not too surprising considering volatile markets, rising interest rates and high inflation will naturally impact financial plans.

“With many advised clients admitting they plan on reviewing how they manage their money, the findings highlight the value of getting professional advice. This can offer invaluable support in making good financial decisions in volatile times and in planning for retirement. With the new Consumer Duty on its way, the research also indicates key opportunities for advisers to add value and deliver good outcomes for their clients into the future.”

Heather Hopkins, Managing Director of NextWealth, comments: “Since starting this research in 2018, we’ve seen a number of significant events that have impacted the demand for retirement advice. Each of those events, whether economic, political, regulatory or health related, were very different in nature but all demonstrate the importance of good quality financial advice when times are uncertain. The resilience and adaptability of those providing this advice has never been more in focus as we move through 2023.”

|