Ben Carey-Evans, Senior Insurance Analyst at GlobalData, offers his view: “Record-high inflation in the UK will result in more people taking up second jobs to afford spiraling monthly bills, which will see an increase in demand for individual commercial insurance. The gig economy allows people a great deal of flexibility as it involves being paid for a particular skill, usually counted by the hour or completion of a particular task. This allows people to take up a few hours a week of services, such as delivering goods, dog walking, or handyman jobs, to top up income.

“GlobalData’s 2022 UK Insurance Consumer Survey found that over a quarter of consumers either took up a second job in 2022 or were considering doing so. This was made up of 14.5% intending to do it in the future and 14.0% having already done it. A further 22.6% considered it but decided against doing so. Nearly 90% (89.7%) of all respondents said that the cost-of-living crisis influenced their decision (62.8% said it was a direct result of it, while 28.5% said it was a factor but not the sole reason). The three most popular second jobs were dog walking (35.8%), delivery services (35.5%), and cleaning on demand (33.3%).

“This will be a boost for the nascent gig economy insurance sector. There is often a grey area between who the insurance responsibility falls on – the employee or employer. But insurers have started to offer cheap and flexible policies, often via apps, directly to gig-economy workers to provide coverage for their key liabilities. More and more workers taking up temporary jobs will increase the size of the potential market for gig economy insurance.

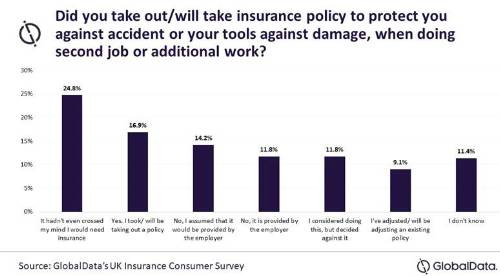

“Our data shows that one thing holding back growth here is people not considering the need for insurance or assuming it had been sorted by their employer. Therefore, raising awareness about how important basic policies can be and making policies as cheap and easy to purchase should help increase their penetration.”

|