Modelling from independent consultancy Broadstone demonstrates the immense financial damage to retirement savings that could be done if pension savers reduce their contributions due to the cost-of-living crisis and then forget or otherwise decide not to resume ‘minimum’ levels of saving.

The data is based on a 2% reduction in employee contributions (taking total contributions down from 8% to 6%, assuming that 3% employer contributions stay constant), on an average salary rising by inflation over the course of a working career and pension saving journey up until State Pension Age.

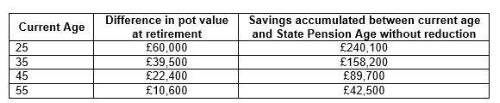

Unsurprisingly, the youngest pension savers have most to lose given the additional years they would be saving a lower proportion of their salary into a pension.

25-year-olds could miss out on as much as £60,000 – a quarter (25%) of the total estimated size of their pot – throughout their pension saving journey, leaving them exposed to a significantly lower income and standard of living in retirement.

However, a 35-year-old would miss out on nearly £40,000 and even a 55-year-old permanently paying 2% less into their pension until reaching State Pension Age could see their pot value reduced by over £10,000.

These losses could be further exacerbated if employers stick rigidly to scheme rules, and reduce their own contributions to employee pension plans if employee contribution levels fall below the normal scheme minimum.

Current Age Difference in pot value at retirement Savings accumulated between current age and State Pension Age without reduction

But even assuming that employers maintain their contributions, retirement pots could be up to a quarter lower if savers cut their own contributions by just 2% in response to the current crisis – a tangible lifelong impact, according to

Rachel Meadows, Head of Pensions and Savings at Broadstone commented: “As household budgets are squeezed more and more towards the end of this year, it is unrealistic to expect all pension savers to maintain their current contribution levels.

“Freeing up some additional income may be a sound and necessary financial decision although we would encourage all people to seek help to see if there are other ways to meet their day-to-day spending given the tax-efficiencies and employer contributions that pension savers benefit from.

“It is crucial, however, that the pensions industry works with schemes and employers to ensure when cost-of-living pressures start to recede that these temporary reductions do not become permanent.

“That is why we are issuing two clear calls to action to employers in the face of these threats.

“The first is that we call on all employers and schemes to maintain records of those staff that reduce contributions, in order that going forwards they can contact savers who have reduced their contributions to encourage them to restore payments back to at least recommended levels. We would expect this to happen every year as a ‘nudge’ to encourage greater saving – ideally at the same time of year as pay reviews take place to aid affordability.

“Our second recommendation is for employers to apply rapid pragmatism to their pension scheme rules to ensure that employer contributions are not reduced (or even ceased completely) if employees need to reduce their own pension savings levels in the face of cost-of-living challenges.

“Keeping to hard and fast rules around scheme minimum contribution requirements at a time like this risks exacerbating the financial harms that will be inflicted on employees – and won’t reflect well on employers.

“The prospect of 25-year-olds entering retirement with around £60,000 less in their pension pot – in a system which is already riddled with fears of widespread under-saving – is hugely problematic. For the sake of our future retirees – and to save greater dependency on the State in retirement – we must get this right.”

|