Research from Legal & General has found that 34% of pre-retirees2 (those aged 55+ who are still in some form of work) have already started phasing into retirement – equating to 3.3 million3 employees.

The study reinforces the idea that retirement is no longer a line in the sand. Almost half (48%) of all employees aged 55+ expect that they will cut down the amount they work rather than completely stopping, with one in seven (14%) planning to wind down in the next year.

Many people want to take the phased retirement route by reducing their hours, so they can keep their job but lessen their stress (37%), however most people have revealed they are making the decision because they simply cannot afford to retire fully (44%).

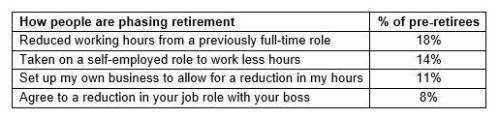

Table one: When asked how people were planning to phase their retirements, the most common answers were:

Source: Legal & General, 2022

On average, over half (54%) of all people who are taking a phased approach to retirement are working 15+ hours less every month, consequently earning £9,150 less every year. As a result, many expect to have to adjust their lifestyle (38%), and some even anticipate they could struggle with meeting the cost of household essentials (17%).

Despite the intention to slow down at work, the cost of living has had an impact, with one in 10 people who had begun to phase into retirement having to increase their work commitments again. In addition, two fifths (40%) of people who anticipated gradually moving into retirement in the next five years now worry living costs might mean this plan is not possible.

Legal & General’s internal data shows the average income on an average pension pot (£73K) for a fixed term annuity (FTAs) taken out by someone aged 55 is £9,000 per year – which could bridge the £9,150 income gap caused by a phased approach to retirement. An FTA lets you use your pension pot to buy a guaranteed income, but for a specific period of time, with a lump sum at the end. This gives greater flexibility for those who want to bridge their income until another source of pension income kicks in.

Lorna Shah, Managing Director of Retail Retirement, Legal & General Retail: The number of pre-retirees considering a gradual or phased move into full retirement shows how much the perception of later life has changed in recent years. However people choose to approach retirement, it’s important they see it as something that should be actively managed, and not something they already feel they are ‘in’ or have ‘done’.

“For those wanting to keep their options open, while also looking for ways to supplement their income, flexible products such as fixed term annuities can play an important role. They provide a guaranteed income for a set time – in some cases as little as three years, helping to bridge any potential gap in salary.

“Most people find it challenging to navigate retirement at the best of times. With the increased pressures applied by the cost-of-living crisis, their money must go further than it ever has done. Ultimately, the key thing is to make sure people are making well informed decisions about what works best for them.”

To help people reclaim their retirement, Legal & General has created a ‘Reclaim Retirement’ hub, which includes free resources to help people better understand their options.

|