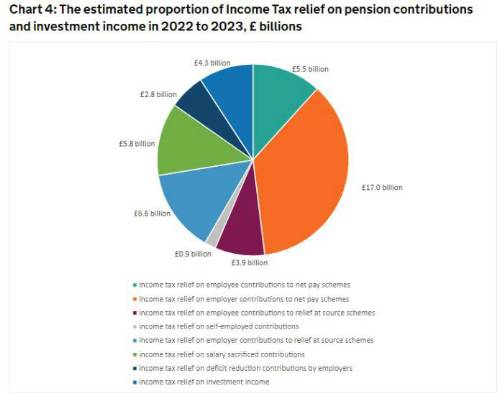

Publication of the figures will inevitably add fuel to pre-Budget speculation about a raid on pension tax relief for savers. However, around a third of the gross cost is National Insurance relief on employer contributions. Furthermore, £5.5 billion of the annual cost of employee tax relief for 2022/23 relates to ‘net pay’ schemes – much of which will be public sector defined benefit (DB) contributions – with a further £5.8 billion attributed to employee salary sacrifice arrangements

Any move to introduce a flat rate of pension tax relief below 40%, as some have suggested, would likely result in a tax charge being applied to higher-rate taxpayers in DB schemes – including those working across the public sector – and lead to questions over the future of salary sacrifice

Tom Selby, director of public policy at AJ Bell, comments: With the new Labour government having ruled out increases to National Insurance, Income Tax or VAT rates, and chancellor Rachel Reeves rather predictably opening the Treasury’s books and claiming the public finances are “worse than expected”, this year’s round of rumours around the future of pension tax relief were inevitable. And on the face of it, numbers from HMRC revealing the overall cost of tax and National Insurance relief is closing in on the £50 billion mark could add fuel to that fire.

“However, this overall figure can be misleading. A huge chunk of that money relates to National Insurance relief on employer contributions, meaning it is mainly firms, rather than individuals, who are benefitting. This would seem a much more enticing target for the government than attacking people’s personal contributions through the introduction of a flat rate of tax relief, as some have suggested.

“Those advocating this reform have yet to spell out exactly how it would be applied practically. The most obvious challenge would be in relation to ‘net pay’ pension arrangements, including defined benefit schemes, the vast majority of which now reside in the public sector.

“Based on the latest estimates from HMRC, £5.5 billion of the tax relief provided to employees in 2022/23 was in net pay arrangements, with a further £5.8 billion linked to pensions salary sacrifice. By contrast, £3.9 billion related to ‘relief at source’ schemes. Given any move to a flat rate of pension tax relief would be motivated largely by raising revenue for the Exchequer, applying the rate to net pay schemes, including DB, would presumably be necessary.”

The impact of flat rate relief on net pay contributions

“So, what would introducing a flat rate of tax relief of, say, 30% mean for members of net pay schemes? For anyone in a DB scheme earning more than £50,270 (the higher-rate income tax threshold), a tax charge would likely need to be applied to reduce their automatic tax relief from 40% to 30%.

“If a higher-rate taxpayer had paid a £10,000 contribution to a net pay scheme in the tax year, they would presumably need to pay a £1,000 tax charge to reduce their tax relief to the required 30%. Given public sector workers were up in arms over the impact of the lifetime allowance and annual allowance on their pensions, it’s hard to imagine hiking tax bills for all those saving in a pension and earning over £50,270 would go down particularly well. Pensions salary sacrifice, a hugely valuable benefit enjoyed by huge numbers of people, could also be on the chopping block in this scenario.

“Beyond these practical hurdles for net pay schemes, there is also the issue of intergenerational fairness – particularly if the government were to opt for a more dramatic reduction in tax relief to, say, 20%. Younger workers who already, on average, benefit from less generous workplace pensions than their parents and grandparents would now also miss out on the potential benefit of higher-rate pension tax relief as they progress through their careers. Any move which potentially deters people from contributing to pensions would also run counter to wider efforts to boost long-term investing, including in UK companies.

“The constant rumour and speculation about pension tax relief is destabilising for long-term savers. Given the new government has committed to stability, providing at least some certainty around the incentives that exist to save for retirement doesn’t seem a lot to ask.”

|