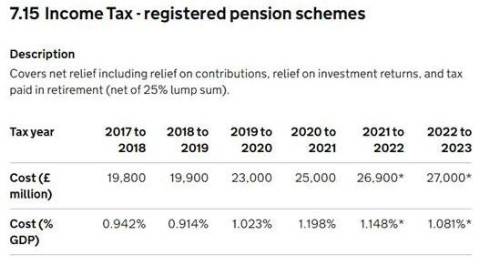

The figures are show in the table below:

Source: Non-structural tax relief statistics (January 2023) - GOV.UK (www.gov.uk), Section 7.15

However, according to pension consultants LCP, the increased cost of tax relief is in large part due to the success of government policies such as automatic enrolment, and should not be used as a justification by the Chancellor to make further cuts in the limits on tax relief.

A key driver of the increased cost of tax relief has been the enrolment of over 10 million extra people into workplace pensions, followed by a step up in the mandatory minimum rate of contributions. The minimum contribution rate was initially 2% when automatic enrolment began but was increased to 5% from April 2018 and 8% in April 2019. This change alone will have contributed significantly to the increased cost of tax relief between 2017/18 and 2019/20.

Since 2019/20, the nominal cost of income tax relief has risen by 17.4% (up from £23bn to £27bn) but this is broadly in line with inflation over the same period. An increased headline cost of tax relief is to be expected as prices and wages go up and does not mean that tax relief has suddenly become ‘too generous’.

Other factors affecting the cost of tax relief include:

- Rising contributions into public sector pensions, particularly from employers;

- Employers continuing to make multi-billion pound contributions into Defined Benefit pension schemes to deal with historical deficits; whilst these payments increase the apparent ‘cost’ of pension tax relief, they provide greater security that member benefits will be paid in full, and are to be welcomed.

Commenting, Steve Webb, partner at consultants LCP said: “If the cost of pension tax relief is rising this should be a cause for celebration not a justification for cuts. The Government has actively encouraged more than ten million people to start saving for a pension and has stepped up the mandatory level of pension contributions. All of this will increase the headline cost of pension tax relief. But this is a sign of the success of the policy. Likewise, if companies put more money into their Defined Benefit pension schemes to make sure pension promises to date are kept, this is to be welcomed even if it increases the cost of tax relief. The Government needs to decide if it wants more people to save in a pension or not. If it does, then constant tinkering and cuts to tax relief is not the way forward”

|