Having a degree still leads to higher lifetime earnings and a larger average pension pot than that enjoyed by non-graduates, but the gap between graduates and non-graduates is set to reduce as the burden of student loan repayments leaves graduates with less money to save into their pension.

Commenting, Jamie Clark, Business Development Manager for Royal London Intermediary pension business said: ‘New graduates are already facing a squeeze on their disposable income which is making it harder for them to get a foot on the property ladder. But this analysis shows that a lack of disposable income is also likely to make it harder for them to save for the long-term as well. We estimate that graduates with student debt could easily end up with pension pots one fifth lower than the levels enjoyed by those graduates who enjoyed tuition-fee free education.’

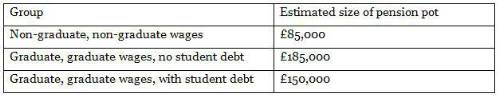

Royal London modelled the likely size of future pension pots for three groups saving through their working life:

a) A non-graduate on average wages;

b) A graduate with no student debt on average (graduate) wages;

c) A graduate with average student debt of £40,000, on average (graduate) wages;

As a graduate with no debt has higher disposable income than a graduate with debt, it is assumed that the debt-free graduate could comfortably afford to put into their pension savings half the amount they would otherwise have spent repaying student debt. The non-graduate and graduate with debts are otherwise assumed to save at the minimum rate required under the automatic enrolment legislation.

The following table shows the estimated pension pots, in current prices, for the each of these cases:

In terms of annual income, and based on an illustrative annuity rate of 5%, the impact of a lifetime of repaying student debt would be a reduced pension income of £1,750 per year throughout their retirement.

Jamie continued; “Although graduates are financially stretched, the figures highlight yet again just how important it is for everyone, including graduates, to start making any contributions into their pension as soon as possible. Increasing pension contributions with a pay rise and maxing out on any employer contributions available, which is effectively ‘free’ money, can really help to build pension savings to help secure a higher income in retirement. Waiting until finances are more comfortable and using some disposable income for pension savings, may then be too late.”

|