ABI analysis of the 500,000 travel insurance claims made last year reveals that:

Travel insurers helped 153,000 British travellers needing emergency medical treatment abroad - the equivalent of 420 people every day, or one person every three minutes.

The total medical bill paid by insurers was £209 million – £570,000 every day - the highest figure since 2010.

Of the £399 million paid out on all travel insurance claims, medical claims accounted for 52% of claim costs, followed by cancellation costs at 36%, then lost baggage or money at 4%.

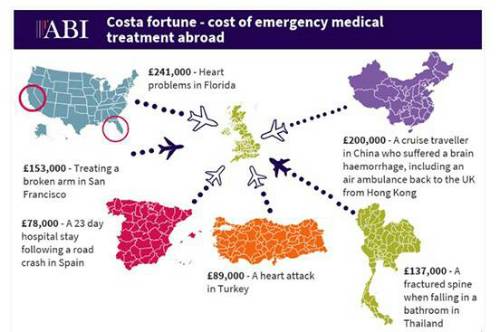

Case studies of the jaw-dropping costs of needing overseas emergency medical treatment include:

£241,000, the estimated cost to treat a couple on holiday in Florida. Following hospital treatment for chest pains suffered by the husband, while on their way to the airport to come home, his wife collapsed with heart problems. After treatment, both returned home, accompanied by a doctor.

£200,000 paid to treat a traveller on a cruise in China who suffered a brain haemorrhage. This included an air ambulance back to the UK from Hong Kong.

£153,000 for treating a broken arm caused by falling out of a bed in San Francisco. This included paying for the flight back home.

£137,000 to treat a fractured spine resulting from a bathroom fall in Thailand, including return to the UK.

£89,000 to pay the medical bill for a holidaymaker who suffered a heart attack while visiting Turkey.

£78,000 to treat an elderly visitor to Spain for a 23-day hospital stay to treat injuries and trauma following a road crash.

Air ambulance costs back to the UK can be jaw-dropping as well: typically, £75,000 from Asia, £50,000 from the US and £13,500 from Italy.

Charlie Campbell, ABI’s Manager of Health and Protection, said: “For too many people holidays can become horror days, if they fall ill or suffer a serious injury abroad. Needing medical treatment can be stressful wherever you are, without the added worry of how you can afford what can be sky high medical bills. Yet the average travel insurance policy costs less than what an average family can spend on drinks and food at the airport and will pay emergency medical bills than can easily run into six figures.

“Also, if we leave the EU without a deal then the European Health Insurance Card will cease to apply, making travel insurance even more vital to have when visiting the EU.”

Five tips for a safer overseas holiday

Get an EHIC. Make sure you have a valid European Health Insurance Card (EHIC) when travelling in Europe. It is free and gives you access to state-provided healthcare available to a resident. However, it is not a substitute for having travel insurance as it will not cover all medical costs, or the cost of emergency repatriation back to the UK. If the UK leaves the EU without a deal, and in the absence of a specific agreement to the contrary, the EHIC will no longer apply. This makes it even more important that you have appropriate travel insurance in place to cover medical costs while you are travelling in an EU country, in the same way as you would when travelling to a non-EU country. Find out more about the EHIC here.

Take the emergency contact details of your travel insurer when you travel. Take the emergency telephone numbers of your travel insurer should you need to contact them urgently. They, or their medical assistance provider, can advise and arrange for any emergency medical treatment that you may need.

Take care and stay safe. Try to avoid putting yourself at any unnecessary risk and always act responsibly. For example, avoid excess alcohol consumption. Generally, travel insurance will not cover accidents if you have not taken reasonable care.

Check if you are covered by your travel insurance for any activities you may do. If you plan any potentially dangerous holiday activity, such as bungee jumping, check if you are covered before you travel. If you are going on an activity holiday, there are specialist travel insurance policies to cover you.

Declare any pre-existing medical conditions before you travel. Tell your travel insurer about any pre-existing medical conditions when you take out your travel insurance. Specialist insurers or an insurance broker can often help in arranging cover.

|