Legal & General initially ran research in May, which found that those between 50-59 had decreased their pension savings by £175 on average. The most recent findings reveal this is still the case with people saving £165 less a month for their retirement, in response to the pressure the pandemic has placed on their finances1.

For many people in the UK who contribute into their employers DC pension scheme2, reductions of this size equate to opting out entirely3, with no idea on when they may be able to start making payments again.

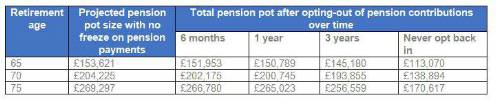

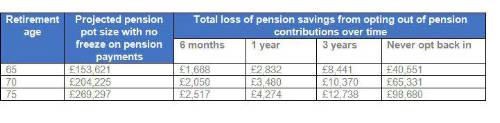

The analysis shows the reality and the impact of freezing pension contributions in ones 50s on the eventual retirement pot at ages 65, 70 and 75 (table 1). Importantly, Legal & General has also calculated the value of re-introducing pension contributions as soon as possible, evidencing the benefitting of reinstating savings after 6 months, a year and 3 years (table 2).

Table 1 – Impact of opting out of pension contributions at the age of 50 for 6 months, 1 year, 3 years and the reality of never opting back in (£ figure represents total pension pot)

Table 2 – Impact of reinstating pension contributions in ones 50s after opting-out for 6 months, 1 year and 3 years (£ figure represents amount lost)

According to the analysis, a 50-year-old earning the average UK wage of £30,566 a year4, with a pension pot of £61,0005 would be nearly £100,000 (£98,680) worse off by the age of 75 if they never saved into their workplace pension again. By opting out of payments, they would be left with a pension pot over a third smaller at £170,617, compared to the £269,297 they would amass if they maintained their regular monthly contributions. This assumes that the individual continues to work full time up until their retirement age.

However, by re-instating pension contributions in 3 years’ time, they would still be able to accumulate £256,559 by the time they are 75, meaning a loss of just £12,738. Opting back in quicker means losses are limited further; paying back into the scheme within a year means losses of £4,274 and a break of just 6 months means being £2,517 worse off in retirement.

A 50-year-old aiming to retire at the age of 70 would be retiring with £204,225 if they stopped contributions entirely, £65,331 less than if they had carried on making regular payments. A three-year break would see this reduced to losses of £10,370, a year £3,480 and a 6-month freeze would see the pension pot reduced by just £2,050.

Many in their fifties may have hoped to retire by the age of 65, but the calculations show how cutting contributions may make this difficult. A 50-year-old who continued to make payments would be left with a pot of £153,621 at 65, but halting payments now would see that reduced by over a quarter to £113,070. Were they able to start making contributions again within 3 years, they would amass a pot of £145,180, missing out on £8,441. Again, getting back to contributing as quickly as possible pays off, with a 1-year break depleting a fund by £2,832 and a 6-month gap by just £1,668.

Chris Knight, CEO, Legal & General Retail Retirement: “The pandemic has thrown millions of people’s retirement plans off course and has inevitably forced many of those struggling to make ends meet to opt-out of their workplace pension.

For those in their fifties, stopping contributions now can have a big impact on their savings and ability to retire as planned. From our own research, we already know that that 1.5 million workers aged over 50 will delay their retirement as a direct result of the Covid-19 pandemic6, with workers who had been furloughed or taken a pay cut during the pandemic most likely to delay retirement.

These are of course challenging times, but while it may be hard to look past current difficulties, it is important not to lose sight of the long-term benefits of saving into a pension to secure a comfortable retirement.

Despite current circumstances proving challenging, we would urge those who have already saved something for retirement to maintain their contributions. Pausing them may be tempting, however people should explore every possible alternative before considering this.

For those who have already taken the difficult choice to opt-out, our projections highlight how vital it is to prioritise enrolling back into the scheme as soon as they are able to do so, to limit the losses to their retirement fund”.

|