The UK’s leading price comparison website analysed 3.1million home insurance claims over the last two years to identify the locations of the highest and lowest rate of claims for home contents theft within a five-year period.

The research reveals a 7% fall in theft rates, with an average of 14.98 claims per 1,000 – down from 16.03 in 2019. After consecutive years of claims increases, the fall is likely due to more homes being occupied as a result of coronavirus restrictions – something which acts as a deterrent to would be burglars.

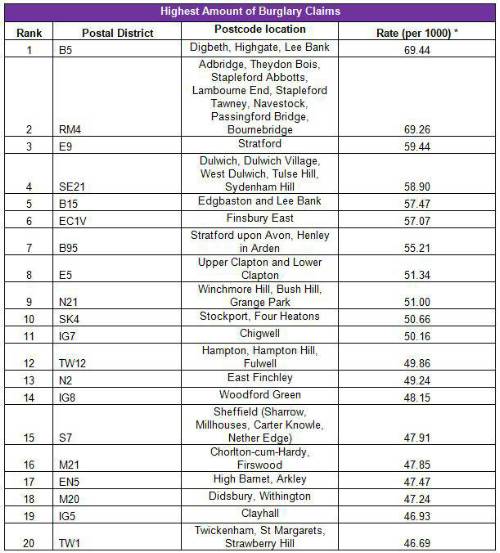

B5 - which covers Digbeth, Highgate and Lee Bank - tops the rankings for a second year in a row with a rate of 69.44 home contents theft claims per 1,000 quotes, up 22% from 57.14 in 2019.

Cities have the highest claims, with 19 postcodes out of the top 20 being located in Britain’s three largest cities: thirteen in Greater London; three in Greater Manchester; and three are in Greater Birmingham. The final one is in Sheffield.

Looking at which locations have the fewest burglary claims, residents of Bideford in Devon are least likely to make a burglary claim with 0.53 claims per 1,000 quotes. The Welsh postcode of SA18 (Ammanford) and PL26 (St Austell) follow, with claims rates of 0.68 and 0.91 per 1,000 quotes respectively.

The research also reveals the top five postcodes with the highest average claims, with Birmingham and Greater London postcodes again featuring prominently:

1. B20 - Birchfield, Handsworth Wood, Perry Barr - £9,250

2. AL2 – St Albans - £5,000

3. RM13 – Rainham - £5,000

4. TW13 – Feltham - £5,000

5. UB3 – Southall - £5,000

Burglaries remain more common in darker months, with claim numbers 22% higher in autumn than in spring. Houses remain the preferred target of burglars and over 12 times more likely to be burgled than flats.

Kate Devine, insurance expert at MoneySuperMarket, commented: “Our research reveals that after a few years of rises, burglary claims started to fall this year – something we believe is most likely linked to the various lockdown restrictions implemented over the past 10 months. With more people at home than normal, it makes sense that potential burglars would see this as a deterrent which could explain the fall in claim numbers.

“While the fall is undoubtedly a good thing, it’s important to remember that burglaries remain a reality across the UK, so it’s important that you protect your home. One way to do this is to look at the type of locks you currently have in your home, to help bolster the security of your doors and windows. Further measures such as burglar alarms, security lights and timers on your indoor lights that give the illusion of occupancy are also effective deterrents against burglars.

“If you’re unlucky enough to have been a victim of burglary, it’s possible that you’ve seen an increase in your premiums. Our research finds that a previous burglary claim adds up to £36 on your premium on average. As a result, it’s always worth shopping around to ensure you’ve got the best insurance cover for your needs. Doing so could save you up to up to £108 on your existing dealII.”

You can check how your area compares to neighbouring postal districts and other locations in the UK by visiting MoneySuperMarket’s interactive Burglary Claims Tool, which displays the rate of burglary claims made in every postal area in the UK. You can also access information on how to improve your home security and reduce the likelihood of burglary by checking out MoneySuperMarket’s Home Insurance Guide Index.

|