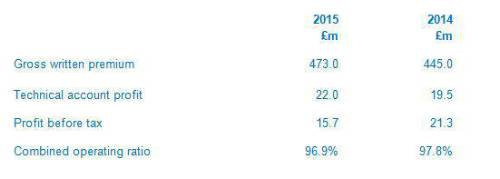

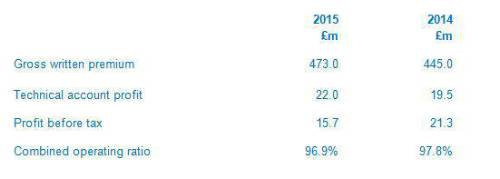

In spite of the improved level of technical profitability, profit before tax fell by £5.6m. This reflects a reduced level of investment income, which was down by £8m as a result of lower yields and market movements.

Even though we continued to experience competitive market conditions, the Company delivered good growth in both Personal Lines Motor and Commercial Lines, with written premiums increasing by 10% and 8% respectively. Personal Lines Home written premiums fell marginally, reflecting the reduction in market premium rates observed throughout 2015.

Personal Lines Motor profitability increased significantly, due to a combination of improvements on prior year claims and an increase in premium levels. The underwriting results for both Commercial Lines and Personal Lines Home deteriorated year-on-year, reflecting both the soft market conditions and the impact of the severe weather events in December, which gave rise to claims totalling £14.2m. As has been reported by other insurers, the impact was most significant on Commercial Lines, which was hit by a small number of large claims.

Announcing the company’s results, James Reader, Chief Executive, commented: “It’s great to be able to announce that we delivered both an increase in written premiums and an improvement in our COR in 2015. Importantly, we also delivered further enhancements to the quality of the products and services that we provide to our customers and business partners, with the way our teams dealt with customers hit by the floods at the end of the year being a perfect example of what we are here for. Overall, the fantastic progress we made during the year once again reflects the skills, effort and enthusiasm of the great team of people we have at Covéa Insurance.

Following the successful integration of Sterling Insurance, we entered 2016 as a broader, stronger business and I remain very confident that we are well placed to deliver profitable growth across all our lines of business over the coming years.”