Danny Vassiliades, Partner at XPS Pensions Group, commented: “Today’s announcement that annual CPI inflation remained at 4.0% in the year to January 2024 shows that the route to lower inflation and lower interest rates remains uncertain. Consensus forecasts are also expecting tomorrow’s GDP estimates to show that the UK was in technical recession during the second half of 2023, having experienced two successive quarters of negative growth.

Whilst these announcements show that pension scheme trustees should continue to monitor sponsor covenants and scheme funding levels, there is reason to be hopeful that monetary policy will soon see inflation decrease.

Despite possible inflationary pressures from the current volatile geopolitical environment, expectations remain that CPI inflation will start falling towards the Bank of England’s 2% target later this year and that Bank base rate cuts are on the horizon.”

Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group said: “Despite some forecasts suggesting we’d see a small increase this month, there will be little love this Valentine’s Day for news that inflation has once again stayed at 4% and you’re likely to find your flowers, chocolates and special treats costing more than they would have in previous years. However, the longer-term forecasts still suggest inflation to fall as we move through 2024. If you’re able to save, now’s a good time to look around for the best deal as banks start to price in the likelihood of the Bank of England lowering the base interest rate in response.

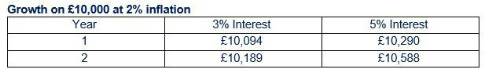

“The best savings rates sat around 6% last year, and now almost all are below 5%. It’s highly likely that we’ll see them continue to fall as we move through 2024. People are famously loyal to their bank, but people can now switch bank with the click of a button, often with a financial incentive to do so and securing the best possible rate really can make a difference over a couple of years – our analysis found that if inflation fell to the Bank of England’s target of 2%, someone with £10,000 to save who grabbed a 5% interest deal could see their savings worth £10,588 in real terms after two years. However, someone with the same amount to save who missed the best offers and picked up a 3% deal would have £400 less after two years (£10,189).

“For those with a greater appetite for risk, investing offers a greater chance of substantial returns, but there’s always the chance of losing money too. People able to take a long-term view could consider saving into a pension, which offers both the benefits of investing and tax efficiency.”

Steve Matthews, Investment Director, Liquidity, Canada Life Asset Management, said: "Inflation remaining at 4% will come as a surprise for many, with expectations of a slight increase in January. However, given the stubborn wage data seen yesterday combined with higher global energy prices and the ongoing developments in the Red Sea, there are still a number of bumps in the road for the Bank of England as it targets 2% inflation.

"Today's data will still support the Bank of England’s cautious stance on cutting rates any time soon, which is backed in general by the market in cutting its expectation for six cuts in 2024 to a more conservative estimate of three - in line with our opinion, with the first movement not expected until June.”

Lily Megson, Policy Director at My Pension Expert said: “Late last year, the Prime Minister celebrated reaching his 5% inflation target. We were told this was a victory, but the reality was that Britons were still grappling with the repercussions of 18 months of soaring inflation. Now, months later, with inflation still at 4%, we can see how premature the government’s back-slapping was – and it’s not good enough.

“The government has struggled to rein in inflation, leaving Britons and their hard-earned savings to bear the brunt. For many, making long-term financial plans has become a minefield, and planning for retirement has become particularly difficult as inflation continues to diminish the real-terms value of people’s pension pots.

“More help is desperately needed. It’s crucial going forward that the government ramps up its support to those struggling with their finances and their financial planning. MPs should be in dialogue with the financial sector to bring policies that ensure Britons have improved accessible routes to financial education and advice, rather than expecting people to navigate the ongoing cost-of-living crisis on their own.”

|