The main reason behind the increase in deficits is likely to be the sustained pressure of long-term interest rates remaining low, rather than directly because of recent developments in inflation. However, if subdued inflation levels encourage the Bank of England to keep short-term interest rates low and this feeds through to long-term rate expectations, then pension deficits are not likely to improve, despite continued cash injections from company sponsors.

Expectations of UK base rate rises have been pushed further into the future, and looking overseas, it was announced last week that the Swiss government will issue 10 year bonds that offer negative interest rates, the first country to do so over such a long period. Further reductions in UK borrowing rates towards this level would make it difficult for schemes to manage asset portfolios against liabilities efficiently.

Raj Mody, Head of UK Pensions Consulting, said:

“There's no need for pension scheme trustees and sponsors to over-react to a couple of months of inflation announcements on this particular measure. Still, it could cause administrative issues for some pension schemes depending on the exact design of their member benefits. If there is sustained deflation then this will become a major issue for a wider range of pension schemes.

"Trustees and sponsors will need to be mindful of the short-term and longer-term likely behaviour of inflation, particularly if they are waiting on certain trigger events - when inflation hits certain thresholds - to take action around managing their pension scheme risk. They may also worry about a sense of 'running to stand still' if deficits don't improve according to their plans, despite cash injections.”

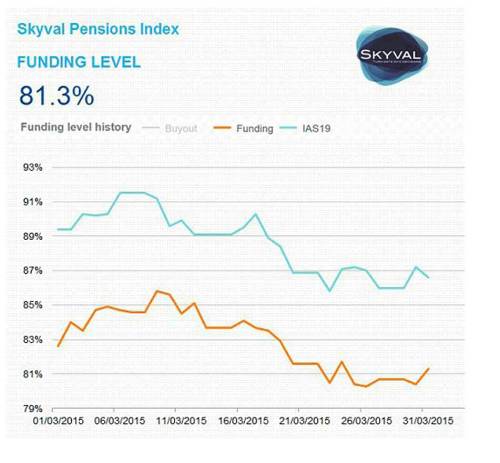

The Skyval Pensions Index, which can track and analyse pension scheme measures in real-time, shows that funding deficits for the FTSE 100 worsened by £13bn over March. Market volatility continues to give rise to large fluctuations in deficits as demonstrated by a movement of £10bn over a single day during March

|