Previously, we discussed how insurance carriers are managing the revision of the claims process, with a view to delivering omnichannel, seamless, Connected Claims. You can find that article here. Having established that Connected Claims transformation requires enterprise-wide involvement and responsibility, we now turn to carriers’ current progress in carrying out the process.

According to past research conducted by Insurance Nexus has shown that the arguments surrounding the value of implementing Connected Claims has been won; it is the claims process that has the largest impact on customers’ perception of their insurance provider, and with the likes of Lemonade and Metromile disrupting the market with quick, personalized and mobile-friendly offerings, customer experience has emerged as a key battleground.

Carriers’ investment into Connected Claims depends on how strong they believe their claims processes to be in the first place; those who believe their process to be ahead of the competition are understandably less likely to invest large amounts into such an initiative.

Despite many carriers having general confidence in their own claims process (and with some justification), there is clearly still work to do. Furthermore, research suggests that although the speed of resolution is important to customers in a claim, when claims stick to the predicted timescale, customer satisfaction increases, regardless of the actual length of resolution time.

This analysis yields two decisive business cases for delivering Connected Claims; undoubtedly, quick and easy resolution of claims processes is important to the policy-holder, but so is transparency and clear communication between the carrier and the insured. If insurance providers are able to embed these aspects into their claims processes, there is evidence that customer loyalty and advocacy will surge as a result.

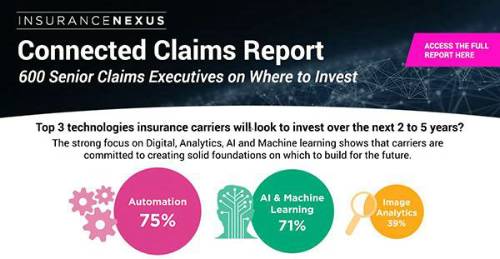

Download Insurance Nexus’ Connected Claims Report 2019 to learn more about the current progress in Connected Claims transformation, including:

• How insurance carriers rate their own claims process against the competition, and does the perception match reality?

• Current budgetary allocations for Connected Claims investment: what proportion of budgets are carriers allocating for investment into delivering Connected Claims?

• How investments in Connected Claims are expected to change, and how these investments match up relative to other projects

Download the Connected Claims Report 2019 here

This report was produced in conjunction with Insurance Nexus’ upcoming Third Annual Connected Claims USA Summit 2019, taking place June 5-6, at the Marriott Marquis Chicago Hotel, Chicago. Welcoming over 750 senior attendees, Connected Claims USA is the world’s largest gathering for claims executives striving for efficient, customer-centric claims processing. More information can be found on the website

I hope you enjoy the report!

Mariana

|