With cyberattacks on the rise post-COVID-19, insurers face mounting pressure to enhance proactive risk management and convince businesses of the critical need for robust cyber protection strategies, says GlobalData, a leading data and analytics company.

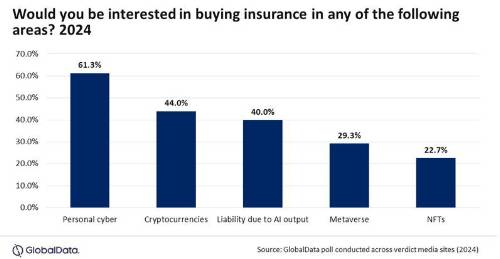

GlobalData ran a poll across Verdict Media’s insurance business websites and found that over a third of respondents expect cyber risk to be the leading threat over the next three years. With companies around the world holding more and more personal data, most businesses are vulnerable to attacks.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, says: “The fallout for businesses can be particularly severe. Within the EU, GDPR (passed in 2016) has resulted in large fines for businesses that fall victim to cyberattacks. The reputational damage on top of that is also extremely costly, as customers will not use businesses they do not trust."

These factors place great emphasis on prevention. Insurers must go beyond traditional policies and focus on proactive risk management, including monitoring and training, to keep businesses safe from the threat.

While macroeconomic and supply chain issues are very topical now and are impacting pricing, experts believe these issues will subside.

Carey-Evans concludes: “Cyber presents a vast threat but also an opportunity for insurers. It is a very difficult line to price and make affordable, which increases the challenge for insurers and deters many businesses from purchasing it. Insurers will need to convince businesses they can protect them against the ever-increasing level of cyber threat and therefore become an essential part of their day-to-day operations,”

*The Poll was conducted on Verdict Media websites over Q1 and Q2 2024.

|