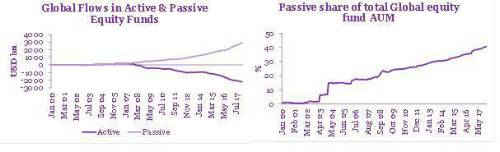

The graph below shows how trillions of dollars have flowed out of active investments and into passive funds, particularly since the financial crash of 2008. As a result (right) passive investing in shares now accounts for nearly half of all assets under management compared with a negligible proportion fifteen years ago. This has been driven in part by a fall in the cost of passive funds but also by the failure of many active investment funds to outperform the market, particularly year-in, year-out.

Whilst the Royal London research endorses the use of passive funds and supports the view that the onus is on active managers to demonstrate that higher costs are delivering value, it also warns about the risks if passive investing were to be totally dominant. These include:

Individuals would be locked in to poorly performing shares, simply because they were part of an index;

Individual investors would be less able to diversify by investing outside the index and could thus see greater volatility in their investments; this is especially true because shares within an index have a tendency to move in tandem with each other;

New businesses looking to raise start up funding would find it more difficult if most investment flows were restricted to established companies covered by share indices;

Managers of businesses would face less accountability, knowing that shareholders would not sell shares that are part of the index which they are tracking; in addition, price competition amongst passive fund managers (who can only compete on price) could drive down the resource allocated to engagement with management to drive up company performance;

Commenting on the research, Piers Hillier, Chief Investment Office at Royal London Asset Management said: ‘There has been a flood of money into passive funds in the last decade as active managers have struggled to demonstrate that their higher charges deliver consistent value for money, and there is no doubt that passive investment forms a valuable part of any investment mix. But there would be dangers both to individuals and to the economy if the benefits of active management were to be lost completely and the dash for passive investment continued unabated. Individuals would have less choice and would be forced to follow the ups and downs of the stock market, whilst business start-ups would find it harder to raise money.

‘More worrying still, without active managers holding their feet to the fire, the managers of British industry would face less challenge and may fail to maximise the potential of their businesses. When investing client money the right judgment is to look for targeted areas where simply following the market does not deliver the best result, and it is important that such active investment continues to be an important part of the UK investment landscape going forward’.

|