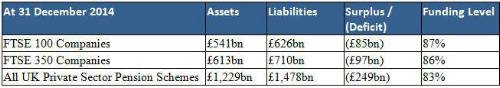

As at 31 December 2014, JLT EB estimates the total DB pension scheme funding position as follows:

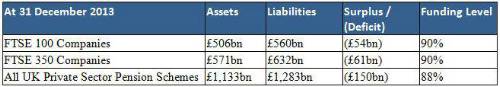

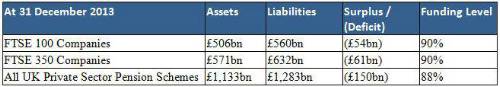

For comparison, the corresponding figures as at 31 December 2013 are as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “2014 has been another tough year for pension schemes. Interest rates have fallen even further - when many experts said they couldn’t continue to fall – and as a result, pension scheme deficits have ballooned. Across all UK defined benefit (DB) pension schemes, the total deficit (on the IAS19 accounting basis) has grown by almost £100bn to a staggering £249bn.

“This is in sharp contrast to how 2014 started. Markets were strong off the back of some good performance in 2013 and there was optimism that the economic recovery was gaining momentum. But whilst there has indeed been some positive news on the economy in 2014, equity markets have stalled – at least in the UK. Worse still, for pension schemes, interest rates have tumbled to even deeper lows and to make matters worse, the Bank of England has suggested that future interest rates might normalise at a level of just 3 per cent per annum, potentially ruling out any respite for pension schemes in the short to medium term.

“So, is it all doom and gloom for pension schemes? No - there is some light ahead in 2015. This comes in the form of the new flexibility available to members of Defined Contribution (DC) schemes. From April 2015 members of DC schemes will be able to cash in their pensions. All the evidence suggests that this new option will be extremely popular. Members of DB pension schemes have long seen the attraction of exchanging part of their pension for cash at retirement – even though the conversion rates in recent years have been extremely poor. Given even more freedom to turn pension into cash, we can expect to see members queuing up to take advantage of this new flexibility.

“This flexibility may turn out to be a ‘DC pensions Pandora’s Box’ bringing some serious problems – the provision of a Guidance Guarantee to all members of DC pension schemes is still looking fraught with difficulties, and how is our society going to pay for increasing longevity in old age if we all cash in our pensions? For hard pressed companies which have got more pension risk on their balance sheets than they can comfortably manage, however, this is potentially a life-saver.

“So, whilst those DB pension liabilities and deficits don’t look like shrinking any time soon, maybe 2015 will be the year when companies are able to start making some real progress on managing down their pension risks and at last beginning to get the issue of DB pensions back off Boardroom agendas.”

|