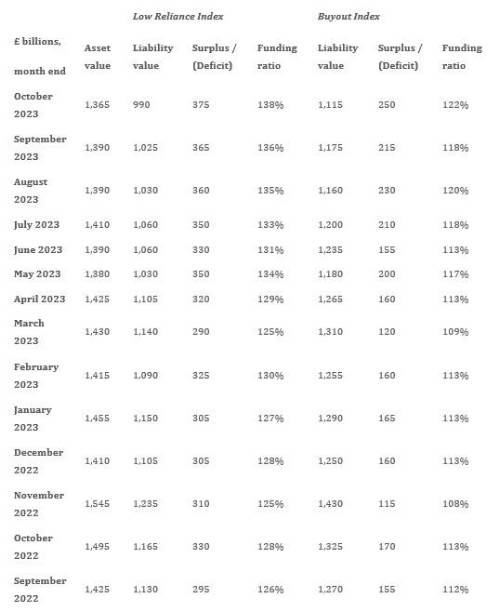

Meanwhile, PwC’s Low Reliance Index also shows a record surplus of £375bn. This tracks the position of the UK’s DB schemes based on a low-risk income-generating investment strategy, which should mean the pension scheme would be unlikely to call on the sponsor for further funding.

These unprecedented levels have led to an increase in schemes considering their end-game strategy. Amidst a booming buyout market, there is an increasing focus on whether more of the assets held in pension schemes can be unlocked to invest in UK growth.

Laura Treece, senior pensions specialist at PwC, said: “With funding levels generally higher and remaining stable, and schemes increasingly hitting their long-term funding targets, the question for many is ‘what’s next’ for their end-game strategy. A recent poll of PwC clients found that four out of 10 pension schemes would choose to run their scheme on if they were fully funded on a buyout measure. This could be for a variety of reasons; from wanting to enhance DB members’ benefits, to using surplus to pay the employer’s current pension contributions, or even just giving themselves more time to prepare for buyout at some point in the future.

Different schemes and sponsors have their own priorities and circumstances, so we are finding that there’s no one-size-fits-all rationale or solution.

“Even more schemes might see run-on as an attractive option if there were legislative changes that made it easier for schemes to unlock ‘trapped’ surplus assets. This may also encourage schemes to invest more within the UK - so members, businesses and the wider UK economy could all benefit.”

John Dunn, head of pensions funding and transformation at PwC, added: “The industry is waiting for an update from the Chancellor in the Autumn Statement later this month on whether or not the Government will provide incentives for pension schemes to run-on and invest more in UK assets.

“Run-on might be a natural fit for large pension schemes with stronger sponsors. Our research reveals that these schemes, whilst only around 200 in number, account for 60% of the sector’s assets under management. If, mirroring our survey, 40% of large pension schemes did run on and they invested 30% of their assets in the UK economy, that’s a pot of £100bn of pension scheme money to kick start growth. Given the complexities of UK DB schemes, accessing this isn’t in ‘low hanging fruit’ territory but the Chancellor may be tempted by the potential reward.”

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|