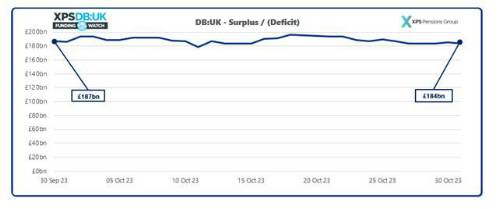

The pensions consultancy estimates that the aggregate surplus of UK pension schemes, when measured on a long-term target basis, stood at approximately £184bn as of 31st October, representing an aggregate funding level of 115%.

A slight rise in long-term gilt yields of around 0.1% led to a decrease in the value of liabilities, but a slightly higher decrease in the value of schemes’ assets driven by hedging strategies and poor performance of growth seeking assets mean that the aggregate scheme surplus was down by £3bn or 1.6% over the month.

This strong position is also reflected in an improved aggregate pensions balance sheet across UK schemes, which will be of interest to scheme sponsors as their financial year-end approaches. XPS’s analysis found that corporate balance sheets are projected to show an estimated aggregate pensions surplus of around £240bn at the end of October, an increase from £170bn as of 31 December last year.

The impact on individual schemes will depend on scheme specifics, but based on interest rate changes and market movements to date, XPS expect that schemes that have hedged less than 100% of their accounting obligations are likely to see an improved accounting balance sheet position compared to last December.

Simon Reddish, Partner and Head of Accounting at XPS Pensions Group said: “These figures illustrate the difference between prudent long-term funding measures, used to determine the strategic direction for many schemes, and the fair value-based balance sheet position calculated using prescribed accounting standards.

This means that it is increasingly important for sponsors to investigate the key drivers of these differences and to understand the potential accounting impact of activities such as insurance transactions. This will avoid surprises and ensure that useful information can be provided to stakeholders.”

|