Aggregate scheme assets increased slightly over May 2024, as equity markets continued their strong year to date, further boosting improvements in DB surpluses.

This increase in scheme assets was broadly offset by a minor fall in long-term gilt yields of 0.06%, leading to an increase in the value of liabilities.

XPS calls on the future UK Parliament to ensure new DB funding code comes into force in September 2024 as planned.

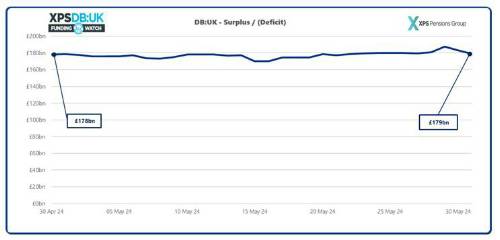

Over May 2024, UK pension schemes’ funding positions rose by £1bn, relative to long-term funding targets, new XPS Pensions Group research shows. Based on assets of £1,441bn and liabilities of £1,262bn, the aggregate funding level of UK pension schemes on a long-term target basis remains extremely positive, at 115% of the long-term value of liabilities, as of 31 May 2024. This was broadly flat on the prior month where the aggregate funding level stood at 114%.

Relatedly, in May, Rishi Sunak announced that a general election is to take place on the 4th of July, putting into question the new DB funding code which was due to be published this summer and take effect from September 2024. The uncertainty around the future Government means that there might be some delays expected to the code, as well as on the progression around options on uses of surplus by DB schemes.

Danny Vassiliades, Partner at XPS Pensions Group said: “As surpluses remain significant, the positive outlook highlights the strong position of schemes looking to run-on. Our recent survey found that 75% of trustees are willing to manage and govern a scheme that runs on for surplus.

The timelines for the release of the new DB funding code should be carefully monitored by employers hoping for emerging surpluses and favourable legislation around recovery. We therefore call on any future Parliament to ensure the funding code comes into effect in September 2024, as delays will only cause pension schemes headaches and uncertainty.”

|