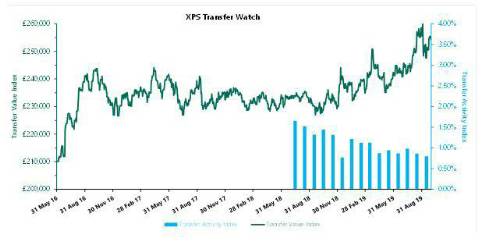

XPS Pensions Group’s Transfer Value Index reached a record high of £260,400 on 3 September before dropping sharply to a low of £247,700 on 13 September. The index recovered to finish the month at £254,300; down slightly from £255,600 at the end of August. The movements were primarily driven by fluctuations in gilt yields over the month.

XPS Pensions Group’s Transfer Activity Index recorded a further fall in the number of transfers completed in September, to an annual equivalent of 0.80% of eligible members, down from 0.86% in August. This is broadly in line with the rates seen in recent months, but significantly down on the rate of 1.30% observed this time last year.

In market news, XPS Pensions Group have seen the average age of members taking transfer values from schemes they administer increase from age 52 to 57 over the past three years. This significant rise is likely to be a result of recent changes to guidance from the Financial Conduct Authority (FCA) which makes it more difficult for financial advisers to recommend a pension transfer to members below the UK minimum retirement age of 55.

Mark Barlow, Partner, XPS Pensions Group commented: “September was a very turbulent month for the financial markets, mainly due to ongoing political uncertainty around Brexit. This has resulted in significant volatility in the Transfer Value Index, with a 5% swing being seen during the month. Despite the recent increases in transfer values being quoted, transfer activity remains close to the lowest levels that we have witnessed in recent years.

“The increase in the average age of DB transferees reveals that transfers are most attractive to members approaching the point of retirement. It is important that trustees and sponsors consider this when setting transfer values, designing communications and helping members to find an appropriate financial adviser.”

|