Asset and liability values both fell over February 2022, resulting in a surplus of £40bn based on schemes’ own ongoing funding measures. PwC’s Adjusted Funding Index shows a £200bn surplus - this incorporates strategic changes available for most pension funds, including a move away from low-yielding gilt investments to higher-return, income-generating assets, and a different approach for potential life expectancy changes.

Raj Mody, global head of pensions at PwC, said: “Pension schemes generally remain well funded based on their own assessments for funding purposes, despite the volatility and disruption in markets over February. Many sponsors and trustees are now revisiting their journey plans - their long-term goals and how they’re going to get there. Those who are focused on securing members’ benefits for good might find that they are closer to that goal than they realise. They should be careful not to build up more money than is needed as there have been many situations of schemes being overfunded and value lost in the process of moving to a third party.”

With PwC’s Pension Trustee Funding Index showing a sustained period of surplus, well-funded schemes that want to transfer to a third party, such as an insurance company, are close to being able to do so. But other assessments of their position are helpful too. Trustees and sponsors should stay focused on the measures which best align with their scheme-specific strategy.

Swapnil Katkar, head of pension risk transfer at PwC, comments: “For schemes planning to transfer their pension risk to a third party, traditional measures of their funding, like technical provisions or solvency, may not give them the best indication of where market pricing is and how it is moving. For example, insurance companies typically invest a significant amount in credit assets like bonds. Their pricing will depend on the returns they can generate in the market, and is therefore heavily influenced by credit spreads on those assets. Schemes considering other market solutions, like consolidators or third party capital backed solutions, would need different measures depending on the target investment strategy and the returns underwritten by the provider. If schemes focus on measures which align with their target strategy, then they will have a better chance of being ready to transact when the time is right.”

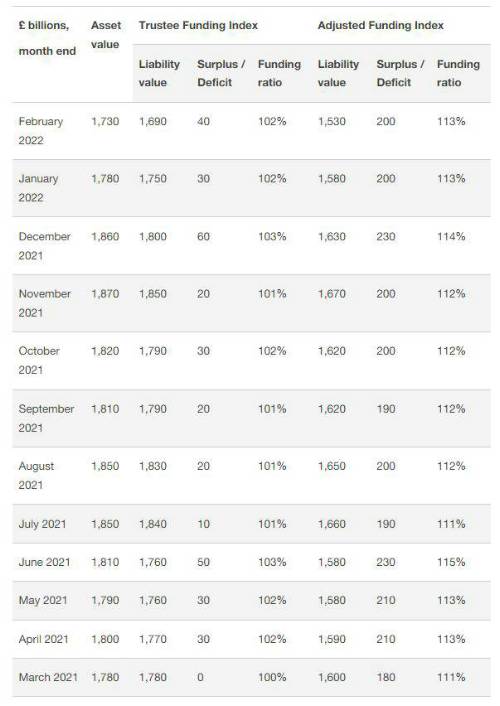

The Pension Trustee Funding Index and Adjusted Funding Index figures are as follows:

|