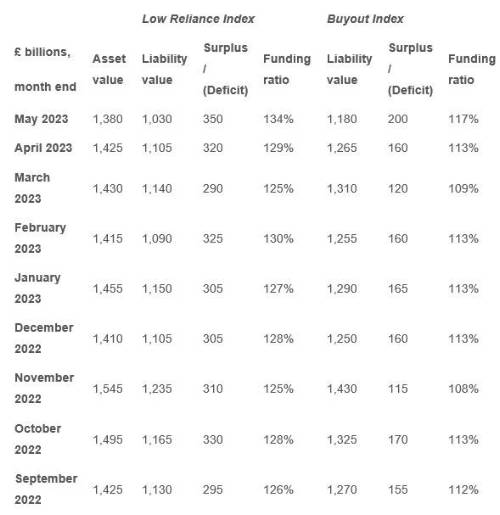

The PwC Buyout Index recorded a surplus of £200bn in May - the rise in gilt yields driving an increase of £40bn on the previous month. Meanwhile, the Low Reliance Index also continues to show a sizable surplus of £350bn. This index assumes schemes invest in low-risk, income-generating assets like bonds, meaning they are unlikely to call on the sponsor for further funding.

John Dunn, head of pensions funding and transformation at PwC, said: “The UK’s DB pension schemes continue to remain well funded, with rising gilt yields driving liability valuations down over the month. While insurance won’t be the right solution for every scheme, we’re now nearing the halfway point of what could well be the biggest year on record for the transfer of pension schemes to insurers.

“We’re seeing new entrants being drawn to a hot demand driven market. At the same time, established insurers are also looking to boost the size of their bulk annuity teams to deal with demand. As a result, some insurers are specialising and becoming more focused on particular areas of the market and deal sizes. We are still seeing an appetite for schemes of all sizes - not all insurers focus on mega deals - but it will be more important than ever for sponsors and trustees to stay close to the market so that they understand capacity and demand for their particular scheme.”

Swapnil Katkar, head of pension risk transfer at PwC, added: “This year, UK pension schemes have unexpectedly found themselves with better funding levels, causing a stampede among many schemes to execute an insurance based risk transfer.

Although there is a robust rationale to this, we are also seeing pension trustees and corporate sponsors assessing the viability of an insurance transaction through both a ‘value-for-money test’ and an ‘affordability test’. For schemes planning to transfer their pension risk to a third party, they need to focus on assessing the suitability of any strategy from an affordability, value and execution readiness standpoint. This ensures that schemes can achieve an outcome that works for all parties, including their members, trustees and corporate sponsor.”

The PwC Low Reliance Index and PwC Buyout Index figures are as follows:

|