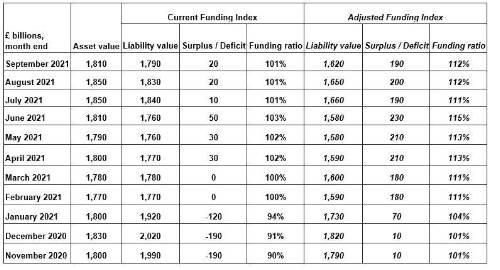

Asset and liability values both fell over September, resulting in a surplus of £20bn based on schemes’ own measures. This is similar to the position last month, with the aggregate funding position staying out of a deficit for the last eight months.

PwC’s Adjusted Funding Index incorporates strategic changes available for most pension funds, including a move away from low-yielding gilt investments to higher-return, income-generating assets, and a different approach for potential life expectancy changes. This measure shows a £190bn surplus.

Raj Mody, global head of pensions at PwC, said: “Our funding index shows that pension schemes on the whole remain in a good position. But even well-funded schemes need to have the right strategies to stay in good health. Recent inflation figures will remind sponsors and trustees of the importance of positive real returns on their asset portfolios.

“Huge demand from pension schemes for index-linked gilts has driven up prices, so these assets now deliver negative real returns. These market distortions don’t only impact assets - they affect liability valuations too. Trustees can unknowingly end up in a situation where their whole approach is built on a misleading picture. They have to ask the right questions of their various advisers to build a complete understanding of alternative and more efficient strategies.”

Laura Treece, pensions actuary at PwC, added: “The supply and demand imbalance for inflation protection in markets means that forecasting inflation using market predictions is not very reliable. Sponsors and trustees should review their inflation forecasts and assumptions. This could have a significant impact on their pension scheme funding level. It might be better than they thought.

“A more accurate understanding would help schemes avoid taking unnecessary risk, or tying up extra cash. These schemes might be closer to their ‘endgame’ than they realise. If their strategy includes transferring to an insurance company or DB consolidator, this also means fewer years of paying running costs, and securing member benefits sooner than expected.”

The PwC Pension Funding Index and PwC Adjusted Funding Index figures are as follows:

|