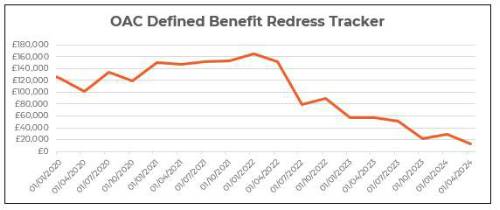

The quarterly Defined Benefit (DB) Redress Tracker from actuarial consultancy OAC (part of the Broadstone Group) shows compensation due to those who were previously ill-advised to transfer out of their Defined Benefit (DB) pension has fallen to record lows.

OAC’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

A slight softening of financial conditions such as interest rates and inflation expectations, coupled with good performance from investment markets means that at the start of Q2 2024 an ill-advised transferor submitting a complaint now could be due around £12,000.

This has more than halved compared to the start of the year, when redress for the same individual would have been over £29,000.

However, redress remains at historic lows compared to just two years ago when an ill-advised transferor could have claimed over £150,000.

Since then redress levels have dropped markedly following the sharp increase in annuity rates over the past 18 months meaning many transferors could now be projected to secure a much higher level of guaranteed income from their pot.

This will minimise the financial disadvantage for those who are seeking compensation after being wrongly advised to transfer their pension, and therefore the compensation they are due.

Brian Nimmo, Head of Redress Solutions at OAC, commented: “Compensation has fallen slightly since the end of 2023, reaching a new low since OAC started monitoring redress levels.

“This decline is driven, at least partly, by good returns from investment markets, with financial indicators such as interest rates and projected inflation remaining broadly stable.

“Redress rates can look quite volatile given it is calculated as the difference between two large numbers which can move in different directions which makes it difficult to second guess how redress will move in individual cases.

“As the FCA brings in new ‘Polluter Pays’ reforms, it will be important for financial advice firms to remain on top of compensation fluctuations as they look allocate capital against potential claims.”

|