By Ali Tayyebi, Partner at Barnett Waddingham

Advanced allowance for discretionary pension increases was typically removed to mitigate the increasing deficits, and employers were increasingly reluctant to fund these increases on a pay-as you-go basis.

One of the consequences of the global financial crisis was a prolonged period of low salary growth. A common argument used by employers to resist the request for discretionary pension increases was that it would be inappropriate to provide discretionary increases to past members when the current employees were not getting a pay rise.

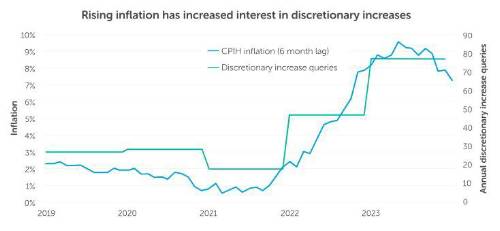

A lot of that has changed over a relatively short period of time. Many schemes are now in surplus on their technical provisions basis and a significant number also in surplus on a buyout basis. Moreover, wage growth has picked up. Does this mean that we might be / should be back in the period where discretionary benefits are more commonly back on the table? The high inflation environment together with the increased awareness of improved funding positions has increased member and trustee enquiries about discretionary pension increases.

When are discretionary benefits awarded?

Historically there have been two main types of discretionary benefits which have been considered by trustees and employers.

At one end we have the question of discretionary pension increases on pensions (typically pre 1997 pensions) which do not have any guaranteed increases and where the scheme rules require the trustees and/or employer to regularly consider whether such increases should be provided.

At the other end there has been the question of how any surplus available at the point of buyout should be used and whether some of it should be applied to a 'windfall' uplift for members more generally.

The latest DWP consultation on 'Options for DB Schemes' perhaps opens up the possibility of a third scenario becoming common: more schemes may decide to run-on beyond a buyout level of funding, with discretionary benefits being provided on a more regular basis to the membership in general (Run-on discretionary benefits) as part of a package which then also allows employers access to the surplus.

Discretionary increases for pensions without a guaranteed increase

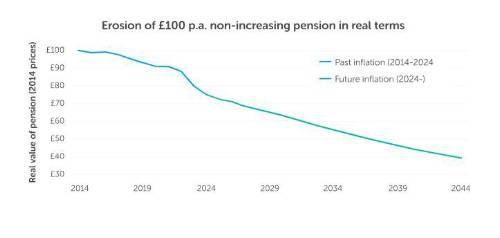

For many schemes, the issue is something that could make a very material difference for a relatively small group of members. A 70-year-old pensioner who has been retired for 10 years on a non-increasing pension will have seen the value of their pension reduce by around 25% in real terms and can expect their pension to reduce by a further 40% in real terms by the end of their expected lifetime. The issue is a very time critical one for these members as each year that goes by without a discretionary pension increase is something they will probably miss out on completely.

All of this makes it more important for trustees and employers to have an agreed strategy on discretionary increases. Is it reasonable for discretionary increases to commence when the scheme has a surplus on a low dependency basis, or should the scheme have to be fully funded on a buyout basis? But if the scheme is fully funded on a buyout basis without discretionary increases, then is it better to secure the guaranteed benefits rather than arguably continue to take some risk with the objective of delivering discretionary increases? These questions do not have a straightforward or universal answer but have important consequences for member outcomes.

It is difficult to avoid the conclusion that providing a discretionary increase in an ongoing scheme without any additional funding doesn’t in some way increase the risk for other members. The key question is how material is that increase in risk and is it reasonable to conclude it is sufficiently immaterial so that, from the perspective of the membership as a whole, the clear benefit to few outweighs any small additional risk to the many?

Wind-up surplus

There is then the question of whether the membership more broadly should benefit from a discretionary uplift from the surplus which is finally crystallised at the point of wind-up. This will be a newer and essentially one-off question for most pension schemes.

Arguably the wording of individual pension scheme rules around the application of surplus in these circumstances make this a little bit of a lottery for members. However, there is often not an insignificant scope to challenge the interpretation of any given wording in the rules.

Trustees will typically have a difficult decision of judgement to apply, with the potential risk of challenge from both employers and members. The recent case of a member’s challenge to the trustee’s decision to refund the pension scheme surplus to Bristol Water plc, highlights the importance of following a robust process to reach any decision. Matters such as the historic pattern of employer contributions, changes in member benefits including contribution levels over time and investment decisions taken will all be relevant to building up a picture of how the surplus arose and therefore what might be an appropriate split of the benefit of that surplus.

Once the proportion of surplus to be distributed to members is identified we then have the question of how this should be distributed across the membership. It would be fair to say any number of possible alternatives might well appear to have some merit – for example should it be a consistent percentage uplift in pension amount, a consistent percentage uplift in the value of benefit, more emphasis on the smaller pensions, or should there be a more sophisticated approach to identifying how the surplus was historically generated and targeting the membership accordingly. Working out the fairest approach might be tricky and there might be a tendency to err on the side of the approach which is simplest to explain.

Run-on discretionary benefits

The Mansion House proposals might create some extra scenarios in between the two bookend scenarios described above, all emanating (initially at least) from the government’s drive to encourage investment in UK productive assets. These are scenarios where schemes could 'run-on' and discretionary benefits could be provided in an ongoing scheme as a quid pro quo to the trustees agreeing to allow the employer to access the surplus as a refund (this would currently require an over-riding change in legislation for most schemes) or for use in providing other pension benefits DC or DB (already possible for some schemes).

The range of considerations in these scenarios will be a mix of those highlighted above, plus a few others!

If a scheme has an explicit provision, say to review pre-1997 pension increases, then should this be given a higher priority when considering how any run-on surplus is distributed between members and the employer?

How would members expectations be managed in terms of discretionary uplifts becoming a regular occurrence?

Are there other preferred ways of distributing surplus to member - for example would it be better to provide a one-off lump sum

instead of a smaller and more permanent uplift to pensions in payment, or to remove/increase the cap on future pension increases?

In conclusion

The market’s focus just now is on how best to facilitate the possibility of employers being able to access surplus from their DB schemes on an ongoing basis. This might ultimately mean many more schemes continuing to run-on for much longer, but the majority of schemes are still likely to look to buyout at some point in the foreseeable future. Both of these scenarios will throw up the question of discretionary benefits for members. Many more trustees and employers are therefore likely to have to turn their minds to the detailed aspects of that question. That will inevitably create its own challenges but clearly it is also an opportunity to make a positive difference to member outcomes – which is ultimately what the pension scheme is all about!

|