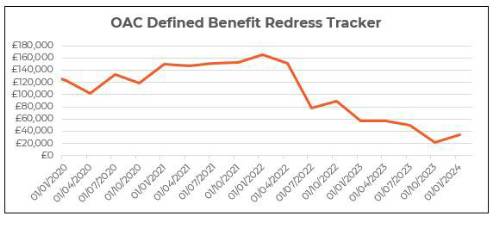

The quarterly Defined Benefit (DB) Redress Tracker from actuarial consultancy OAC (part of the Broadstone Group) shows compensation due to those who were previously ill-advised to transfer out of their Defined Benefit (DB) pension has risen for the first time in two years.

OAC’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

Falling gilt yields towards the end of 2023 as market expectations of Bank of England base rate cuts grew meant that at the start of Q1 2024 an ill-advised transferor submitting a complaint now could be due around £34,000.

This is an increase from the £22,000 recorded in Q4 2023, however it still marks a notable drop in redress levels compared to two years ago when at the beginning of Q1 2022, complainants could have claimed around £165,000.

Since then redress levels have dropped every quarter until now following the sharp increase in annuity rates over the past 18 months meaning many transferors could now be projected to secure a much higher level of guaranteed income from their pot.

This will minimise the financial disadvantage for those who are seeking compensation after being wrongly advised to transfer their pension, and therefore the compensation they are due.

Brian Nimmo, Head of Redress Solutions at OAC, commented: “Our DB Redress tracker seeks to illustrate the levels of compensation available to those who make a claim against the poor advice when they transferred their pension.

“Since the start of 2022 redress has fallen significantly due to the rise in annuity rates. This means complainants could have increasingly secured a healthy guaranteed income from their DC pot through the annuity market in place of their DB pension.

“It now looks like compensation may have bottomed out as we appear to have reached the end of the rate hiking cycle with gilt yields and annuity rates now starting to come down. Redress levels are still far below their historic levels due to the changed economic situation and are worth monitoring as we progress through 2024 and beyond.”

|