Typical DB transfer complainant now likely to receive no compensation

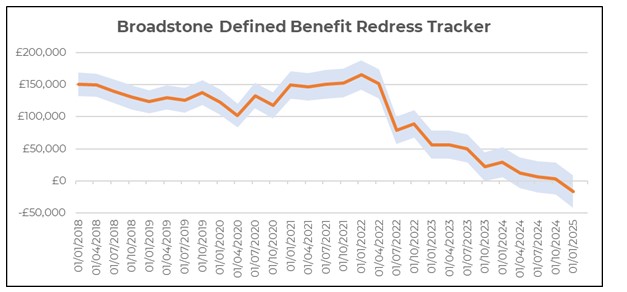

The quarterly Defined Benefit (DB) Redress Tracker from leading independent financial services consultancy Broadstone provides an indicator of the level of compensation due to those who were previously ill-advised to transfer out of their DB pension.

Broadstone’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

The latest update shows that compensation for a typical pension transfer redress case continues to fall and in many (or even most) cases, there may not be any redress payable. This trend continued at pace in 2024 and accelerated in Q4 2024 as gilt yields rose markedly, decreasing the assessed value of the transferred DB liabilities while asset values rose further. With financial conditions softening and rates rising, the Redress Tracker demonstrates the radical decline in potential DB redress since the start of 2022 when average compensation for the use case was above £150,000.

The range within which redress can fall will depend on the generosity of the original transfer value and the investment performance since but it is now becoming more common for there to be no redress payable in many cases.

Brian Nimmo, Head of Redress Solutions at Broadstone, said: “The changing economic environment has driven a sea-change in DB transfer redress, primarily due to the influence of increasing gilt yields. There will now be many cases where no loss is experienced for those transferring out of their DB pension due to effective investment performance and the size of the original transfer value. As our Redress Tracker demonstrates, this is a radically difficult scenario from just a couple of years ago when our average complainant could have been entitled to over a hundred thousand pounds.

“However, it is also true that many individuals still face losses requiring redress and, with the potential requirements of CP23/24 coming down the line, it is important that financial advisers are preparing appropriately. This is likely to require expert, specialist advice and actuarial support to help them scope out how much capital is needed to be set aside for possible claims.”

|