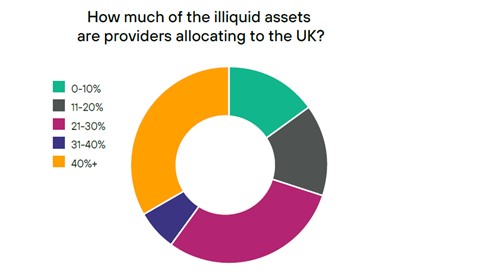

A diversified asset allocation approach is favoured by most providers, with investments in property, infrastructure and private equity the most popular asset classes. Most providers will rely heavily on external investment managers, although some will make use of in-house capabilities where appropriate. A third of master trust providers are intending to invest 40% or more of their illiquid allocation within UK assets

Isio has published findings from its latest research into the use of illiquid assets among 15 major providers of defined contribution (DC) master trusts. The study reveals that providers are directing an outsized portion of these investments towards UK-based opportunities, with the majority planning to invest between 21% to 30% domestically and some committing over 40%.

This shift reflects both the influence of government initiatives, such as the 2023 and 2024 Mansion House reforms, and a broader focus on UK infrastructure and real estate as attractive long-term investment opportunities. As of yet, specific allocations to UK venture capital are rare, with currently most providers considering this as part of a broader private equity mandate.

Size of illiquid asset allocations

Isio’s research finds that target allocations vary between less than 5% at one end of the market, but rising up to 30% at the other end. The variance accounts for two emerging approaches to illiquid assets within default strategies – either one single default with a modest allocation to illiquids, or a core and premium approach, where the former has a minimal illiquids allocation and the latter has a higher allocation. The core and premium approach is currently the more popular in the market, with the intention for it to cover two different cost points and to target different levels of investor sophistication. While the scale of allocations varies significantly, the trend is clear – illiquid assets are set to play an increasingly important role in DC default investment strategies.

Which illiquid asset classes are most popular?

Master trusts are increasingly taking a multi-asset approach to private market allocations, with real assets, particularly infrastructure and property, and private equity leading the way. These asset classes account for over two-thirds of each providers’ asset allocation. Some providers are also taking a greater interest in natural capital, reflecting the fact that illiquid assets are where greater impact can be achieved from a sustainability perspective.

Which asset classes are being used to provide liquidity?

Master trust providers are most commonly planning to use cash to provide liquidity, closely followed by listed equities due to a desire to maintain long-term returns. Listed private equity, listed infrastructure, REITs, insurance-linked securities, and liquid credit are also commonly used. Long-Term Asset Funds (LTAFs) remain a key implementation vehicle, but the report found some providers are also exploring co-investment and direct investment models within these structures.

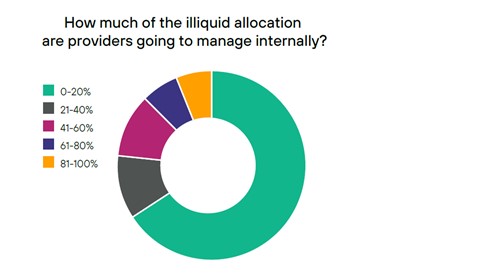

Internal vs external management: balancing expertise and cost

The research finds that master trusts will predominantly rely on external expertise for illiquid assets, with the majority managing less than 20% of illiquid allocations internally. While some are understandably planning to make use of in-house capabilities where they exist, external managers continue to play a significant role in providing specialist expertise. The choice between internal and external management is often influenced by cost considerations, scale, and governance requirements, with some providers using a mix of both within their illiquid portfolios.

George Fowler, Partner at Isio said: “Our research shows a clear shift towards greater investment in illiquid assets within DC master trusts, albeit with significant variation in both the size of allocation and whether one or two defaults are being offered. This will provide a genuine choice to the end investor. Within the illiquids allocation, we are also seeing a sizeable allocation to the UK, albeit this is more focused on UK infrastructure and property than venture capital to date. Although we believe allocating to illiquid assets has the potential to improve member outcomes, this will only happen with effective implementation, with approach to ramping up, managing liquidity and the appropriate balance between internal and external management being key areas to watch out for.”

|