Most workers in the UK are saving via auto-enrolment into a defined contribution pension scheme. Of these, the vast majority can expect their pension to be invested in the ‘default investment strategy’, which is governed by a trustee board, responsible for getting the best outcomes for their members.

Leading independent consultancy Barnett Waddingham has analysed 22 of those governed default investment strategies, across 18 providers.

The analysis reveals that after a difficult 2022, 2023 brought some much-needed good news to employees in the UK - performance was positive, across all age groups of members. This was largely due to rising equity markets and reducing bond yields. When observing the 1-year growth portfolio performance for 2023, the average growth across all 22 schemes was 12.8%. This compares to 2022 which saw negative growth of -9.5%.

But looking more closely at performance, there was a significant gap between the best and worst performers, led primarily by strategic asset allocation. The gap was almost 10% in the growth phase and around 8% at-retirement.

Strategies which had equity portfolios that were predominantly global did better than those with more evenly weighted portfolios. In particular, the comparatively poor performance of the UK market detracted returns for those with a UK bias.

Diversification was also a performance detractor, as all other asset classes - like bonds and commodities - failed to keep pace with equity markets. In particular, strategies with investments in property (physical and listed) suffered as a result of difficult conditions within the sector.

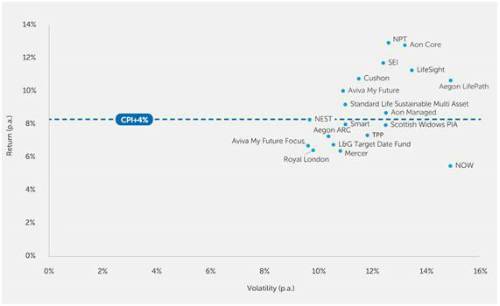

When looking more broadly however, scheme performance over the five years to 31 December 2023 helps to provide a more balanced picture than the short-term view, capturing the impact of Covid-19 and the turbulent market conditions of 2022. When looking at the growth portfolios for all Governed DC Default strategies across this period, there were positive annualised returns as schemes achieved average growth of 9%.

Default schemes will differ for older members who are approaching retirement, as those savers typically need less volatility to help with budgeting and planning. Looking at this ‘at retirement’ phase, improvements in bond markets over the course of the year provided some welcome relief for older scheme members, reducing volatility (relative to positions in 2022) and providing greater certainty of outcomes for these members. Bonds remain the primary defensive asset used by Governed DC Default solutions in the approach to retirement and many members will have been faced with difficult decisions towards the end of 2022.

Mark Futcher, Partner and Head of DC at Barnett Waddingham said: “After a turbulent year in 2022, members in default DC pension scheme strategies have seen some reassuring growth in 2023, allowing trustees to pause for breath and look to the future.

“The next few years will be some of the most critical in the life of governed DC default solutions as they look to introduce allocations to private markets and meet the needs of members as they enter retirement – all amidst an ever-changing market and regulatory environment. Mansion House and long-term asset funds (LTAFs) have invigorated interest in illiquid asset classes, but allocations remain very limited across governed DC default solutions - achieving a meaningful allocation to illiquid asset classes throughout the glidepath is essential to truly improve member outcomes.

“Within this, the cost/ value balance will be critical. Commercial constraints are driving many providers to launch new more expensive governed DC default solutions in order to access illiquid asset classes. It will be interesting to see how these new solutions interact with existing solutions. However it plays out, a general shift in investor attitudes from ‘cost’ to ‘value’ is essential, and schemes must be able to clearly articulate how their investment decisions benefit members themselves.”

|