Meanwhile, industry indexes that focus on accounting deficits actually worsened over the same period, leading First Actuarial’s Rob Hammond, to ask: “Deficit - what deficit? The UK’s 6,000 DB schemes are in aggregate running a healthy best estimate surplus. When commenting on pension funding, we’d encourage those giving answers to make everyone aware of what question they are answering!”

Hammond added:“The FAB Index answers this question: What is the deficit (or surplus) of the UK’s 6,000 defined benefit pension schemes calculated using best estimate assumptions?

“As there is no prudence in the assumptions used, it is not a suitable basis for funding purposes, but provides trustees and employers with a useful measurement to consider along with the buyout position, when deciding how to fund a pension scheme. Knowing both of these measurements helps trustees and employers to see explicitly how much prudence is being allowed for in funding assumptions.

“Deficits calculated for PPF and accounting purposes answer completely different questions. Much of the media’s attention in recent months has focused on soaring accounting deficits, which have been largely caused by low bond yields, and don’t necessarily translate into increasing funding deficits.”

The technical bit

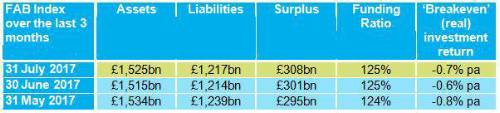

Over the month to 31 July 2017, the FAB Index improved, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes increasing from £301bn to £308bn.

The deficit on the PPF 7800 index also improved over July from £186.2bn to £180.1bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best estimate basis – the so called ‘breakeven’ (real) investment return – has remained at around minus 0.7% pa. That means the schemes need an overall actual (nominal) return of 2.9% pa for the assets to meet the liabilities.

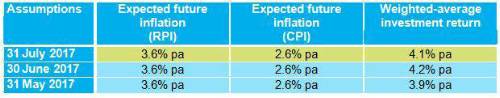

The assumptions underlying the FAB Index are shown below:

|