Defined benefit (DB) pension plans – those that promise a guaranteed level of pension for the retiree’s lifetime – continue to weigh on the financial health of the organizations that have made such commitments. As Ian Markham, Canadian Retirement Innovation Leader at Towers Watson explains, “DB plan sponsors will continue to feel the impact of the double-whammy we experienced in 2011 – a combination of declining long-term interest rates and poor equity market performance. For many organizations, these conditions have resulted in larger plan deficits at the end of 2011 and will lead to higher pension costs in 2012 and beyond.”

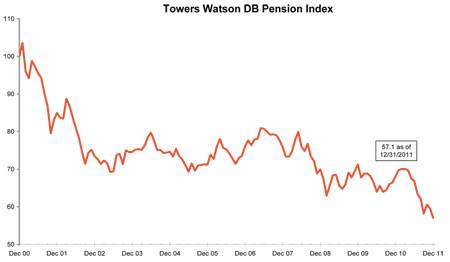

The Towers Watson DB Pension Index tracks the performance of a hypothetical DB pension plan that was fully-funded in the plan sponsor’s financial statements at the end of 2000. The financial health of the plan is tied to two important measures – investment returns, which boost the amount of assets held in the pension fund, and the level of long-term interest rates on corporate bonds, which determines the amount of assets that are theoretically needed today to pay the future benefit promises made to current plan members.

The combined effects of poor investment returns and decreasing interest rates during 2011 caused the DB Pension Index to fall 16.2%. (See chart below). Based on data collected by Towers Watson, this would mean that the typical DB plan, which was 86% funded on an accounting basis at the start of 2011 (the median of a database of companies being tracked by Towers Watson), will find itself at only 72% funded at the end of the year, unless the plan sponsor has made additional contributions during the year to shore up the plan’s financial health.

As most Canadians know, 2011 was a difficult year for investors, and in particular for pension plans. The typical 60%/40% allocation of pension plan assets to stocks and bonds used for the Pension Index would have only generated 0.5% returns over 2011, while pension plan liabilities would have increased by close to 20% due to the decline in interest rates over the same period.

As Roland Pratte, a Senior Investment Consultant at Towers Watson notes, “DB plan sponsors are acutely aware of the downward trend in interest rates, and potential volatility in the stock markets. In response, many have already taken steps to reduce the size of their DB pension liabilities. For 2012, plan sponsors should continue to work on managing their pension financial risks with focus on both the investment and plan design fronts, and paying careful attention to their ongoing plan funding strategies.”

|