While putting money away for retirement might not seem like an immediate priority in your twenties, young people are being urged not to neglect pensions savings as new analysis from Standard Life, part of Phoenix Group, reveals that saving sooner could leave you more than £50,000 better off in retirement.

The longer you wait to start contributing to your pension the more you could miss out on in future

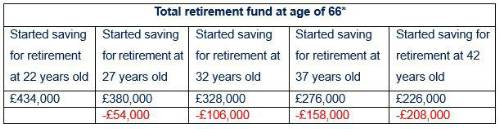

Standard Life’s analysis finds that those who begin working on a salary of £25,000 per year and pay the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could have a total retirement fund of £434,000 by the age of 66, not adjusted for inflation. However, waiting just five years until age 27 to start contributing could result in a total pot of £380,000 – £54,000 less. Waiting even longer could have an even bigger impact on a retirement pot:

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

The key difference is that those who begin paying into their pension later in life could miss out on the power of compound investment growth. Of course, a balance must be struck between putting money away for future and meeting near term costs and goals, but these figures highlight the challenge that delaying saving for a number of years can create in the long-run.

Dean Butler, Managing Director for Retail Direct at Standard Life said: “It’s remarkable to see how just a five-year delay in saving in your 20s can significantly reduce the pension you retire on by tens of thousands of pounds. At the start of a career and when first earning money it can be tempting to spend as much as possible. However, as our analysis shows, if your finances permit and it’s appropriate for your circumstances, the sooner you engage with and begin to contribute to your pension, the better your ultimate retirement outcome could be.

“It’s also worth considering the potential retirement impact of joining the workforce a bit later in life, for example to stay in higher education for longer. While this could pay off both in terms of future earning potential and personal fulfilment, you might find you need to increase your contributions in the future to reach your expected retirement pot. If you decide to become self-employed in your twenties, consider opening a personal pension as you won’t be auto enrolled into a workplace pension and could miss out on valuable early-career contributions.

“Our calculations show that contributing to your pension from the very start of your career can mean the potential investment growth is much more significant and can result in a much larger retirement pot. For those in a position to do so, consistently paying into a pension from as early an age as possible and topping up payments, especially in your 20s, 30s or early 40s, can make a massive difference over time. The longer you wait to start the worse off you could be by the time you stop working, so if you’re able to save into a pension your future self is likely to thank you for it.”

|