Recent Aegon research found a quarter (25%) of people had changed their plans for retirement since the pandemic and around 1 in 7 (15%) have considered accessing or have already accessed their pension funds earlier than planned.

However, the current cost of living crisis poses new challenges for those considering their retirement options as soaring prices raise concerns over whether future retirees will have enough income to maintain their pre-retirement lifestyles or even just ‘get by’. Aegon analysis shows that remaining in work and continuing to contribute to your pension could provide a significant boost to yearly retirement income.

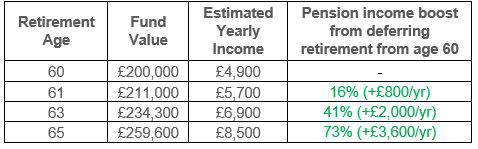

For an employee aged 60 with a pension of £200k, this could provide a retirement income of around £4,900 per year. However, deferring retirement for one year (to age 61) and continuing workplace pension contributions of £200 a month could mean the fund has grown to £211,00. And with one less year of retirement to spread the fund over, this could provide an income of around £5,700 per year – an additional £800, or 16% higher.

The longer you remain in work, the more significant the boost to your retirement income. For this same individual, delaying retirement by 3 years (to age 63) with ongoing contributions could mean the pension fund has grown to £234,300, providing a yearly income of around £6,900 – an additional £2,000 or 41% higher. Delaying by 5 years (to age 65), could mean the pension fund has grown to £259,600, providing a yearly income of around £8,500 – an additional £3,600 or 73% higher.

On reaching state pension age, those with a full entitlement will currently receive £185.15 per week, a significant boost to any private pension income. So delaying retirement till closer to state pension age avoids having to ‘bridge the income gap’ till then.

Steven Cameron, Pensions Director at Aegon comments: “We’ve seen large numbers of over 55s moving into early retirement during the pandemic, some because of lost employment or poor health, but others through choice. However, soaring prices means many retirees relying on fixed incomes are currently under huge pressures as their purchasing power tumbles. And for those drawing down a retirement income flexibly, any increase in the amount taken from their pension carries the risk of depleting pension savings earlier than planned.

“While some may not have the choice, individuals considering their future retirement options should consider the benefit of remaining in some form of employment. Not only can employment offer a sense of purpose, but the financial benefits extend beyond maintaining your current income to increasing your future retirement income as well. This is due to the triple boost to your pension from continued investment returns on your pension pot, further pension contributions from you and your employer, and fewer years to spread the fund over once retired.

“Every year retirement is deferred can make a difference to the level of pension income you receive. The actual difference will depend on how much you’ve already built up, future investment returns and how much you and your employer keep paying in. A financial adviser is best placed to support you on the retirement options available.”

The value of investments may go down as well as up and investors may get back less than they invest.

Table showing the how deferring your retirement age could boost future pension income

Aegon analysis June 2022, assumes 4.25% investment growth (after charges), numbers rounded to nearest £100.

|