The Finance (No. 2) Bill, published this week, sets out key details about how these rules will operate in 2023-24

Those with enhanced protection and fixed protection registered before 15 March 2023 can from 6 April 2023 pay in new contributions to their pension plans and keep their existing protected tax-free cash entitlement…

…But, under the new rules the maximum amount of protected tax-free cash someone with enhanced protection can take will be restricted to the amount they could take on 5 April 2023.

Rachel Vahey, Head of Policy Development at AJ Bell, comments: “This Finance Bill is the first piece of legislative machinery needed to change the lifetime allowance rules for pensions. As expected, no-one will have to pay a lifetime allowance charge again from 6 April 2023.

“But it’s worth taking a close look at the detail. The Bill also has new rules for those who have previously protected a higher lifetime allowance and higher tax-free cash amount.

“Those with enhanced protection will be able to take advantage of the new higher annual allowance (AA), allowing them to top-up their pension without fear of a tax hit. But if their protection certificate shows a tax-free cash percentage, then this entitlement will be frozen on 5 April 2023.

“In effect, it means that none of the future growth in their pension pot, from both contributions and investment growth, can be withdrawn as tax free cash in the future.

“These changes still allow pension savers to super-charge their pension pots over the next few years. But this crucial rule freezes the amount they can withdraw tax-free, with HMRC preventing those with enhanced protection from completely exploiting the new regime.”

Example of someone with enhanced protection

A pension saver registered for enhanced protection in 2006, when their pension benefits were worth £1.5 million on 5 April 2006. Their protection certificate shows their protected tax-free cash percentage is 25%.

On 5 April 2023 – this tax year – their fund is now valued at £2 million. If they took their benefits then, their tax-free cash would be 25% of £2 million, £500,000. As they have enhanced protection, they would not face a lifetime allowance tax charge.

In the next tax year, they re-start funding their pension and pay in a £60,000 contribution (up to the new annual allowance). On 1 April 2024 their fund is now worth £2.2 million. If they took all their benefits, as before, they would not face a lifetime allowance charge. But although their fund has increased, their available tax-free cash remains at £500,000 (and not £550,000, 25% of £2.2 million).

How do enhanced and fixed protections work under current rules?

Enhanced protection:

Enhanced protection was available to anyone with any level of benefits at 5 April 2006. With this protection when the member took benefits, no lifetime allowance charges would arise, regardless of the size of the fund being crystallised.

Pension scheme members had up to 5 April 2009 to register, and those who did received a certificate.

From 2012/13 the Pension Commencement Lump Sum (PCLS, or ‘tax-free cash’) for those with enhanced protection is limited to a maximum of 25% of £1.5 million or the standard lifetime allowance, whichever is higher.

It was also possible to hold enhanced protection with lump sum protection if the individual’s lump sum pension rights were more than £375,000 at 5 April 2006. The lump sum rights are expressed as a percentage of the certificate. The member is entitled to that percentage of their fund as a PCLS regardless of the size of fund they are crystallising. The percentage can be more or less than 25%.

Enhanced protection is normally lost if there is ‘relevant benefit accrual’, which broadly means if the member builds up benefits either in their defined benefit scheme or by contributing to a defined contribution scheme. It is also lost if certain types of pension transfers are received or made, or if the member becomes a member of a new pension arrangement (unless it’s a transfer of their existing rights).

Fixed protection:

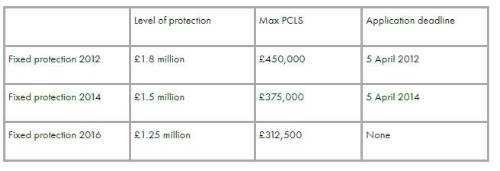

There are three forms of fixed protection, each introduced when there was a cut to the standard lifetime allowance.

All the fixed protections operate in the same way, but they give different levels of protection. There was no requirement for a minimum fund size at any particular date, but the protection is lost if there is any benefit accrual or any contributions are made after the application deadline (or after 5 April 2016 for fixed protection 2016).

There is no separate PCLS protection available with any of the fixed protections. The maximum PCLS available will always be 25% of the protected amount.

HMRC issued certificates to those who have been granted fixed protection 2012 or fixed protection 2014. Those with fixed protection 2016 received a protection reference number online.

Fixed protection is normally lost if the member either builds up benefits in their defined benefit scheme or contributes to a defined contribution scheme. It is also lost if certain types of pension transfers are received or made, or if the member becomes a member of a new pension arrangement (unless it’s a transfer of their existing rights).

|