The mutual insurer highlighted ongoing market uncertainty leading to inevitable periods of stress. Expected returns across all asset classes have reduced significantly over the past decade and this combined with increased volatility has led to a wider set of returns across the range of risk profiles. Different asset class types are helpful to optimise efficiency of returns and ensure investors are fairly rewarded for any risk being taken.

Royal London’s 11 year old Governed Portfolios comprise nine risk graded portfolios designed according to risk appetite and investment horizon. The portfolios are one of the biggest multi-asset propositions designed for pensions with over £37bn in assets under management and 1.3m policy holders as of January 2020.

They are invested across 8 different asset classes including equities, property and commodities. Using alternatives such as property can reduce risk while maintaining, or even increasing, expected returns.

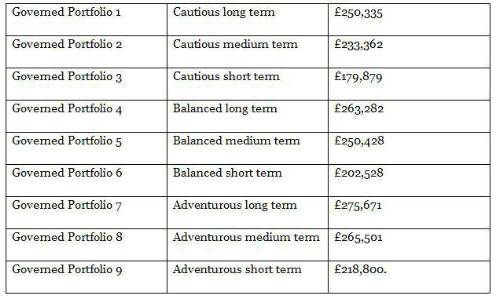

Adopting this approach means the Governed Portfolios have posted strong returns over the past 11 years. An investment of £100,000 placed in Governed Portfolio 5, which is aimed at the balanced medium term investor, on launch would now be worth over £250,000. The same amount invested in Governed Portfolio 7, aimed at the adventurous long term investor, would be worth more than £275,000 today (see table below).

Royal London Intermediary’s head of investment solutions, Lorna Blyth, said: Long term expected annualised returns have reduced by over 50% since 2009 for the majority of asset classes. This is against a backdrop of unprecedented global political uncertainty.

“Diversification and robust governance help us ensure that investors do not incur undue levels of risk as they look to generate returns. Pension investors need to know they are invested in something that can deliver returns in even the most challenging conditions and through diversification and strong risk management the Governed Portfolios have done exactly this.”

Table 1 – Value of £100k single investment made on 12.01.2009

Values as of 12.01.2020. All returns shown are net of 1.00% annual management charge.

Past performance is not a guide to the future. Prices can go down as well as up. Investment returns may fluctuate and are not guaranteed so you could get back less than the amount paid in.

|