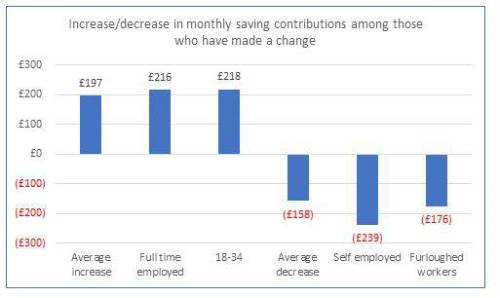

The average increase among those who are saving more is £197, but is even higher among those in full time employment. More than 4 in 10 (43%) of those in full time employment and not furloughed have been able to increase their savings with the average additional contribution being £216. This increase is significant and equivalent to around 10% of average monthly earnings**. Young people aged between 18-34 have been disproportionately likely to increase their savings, with an average increase of £218.

In contrast, 3 out of 10 (28%) savers have decreased or stopped saving with an average cut of £159 per month. The greatest reductions in savings are amongst the self-employed where over half (53%) have decreased saving by an average of £239 and furloughed workers where over 4 in 10 (42%) have decreased savings by an average of £176.

Steven Cameron, Pensions Director at Aegon said: “While the coronavirus is first and foremost a health crisis, it is also having a big impact on the nation’s wealth. Our consumer research shows 6 in 10 of the population have changed their savings levels since the start of the crisis with a stark divide between those who have been able to save more because their expenditure in lockdown has reduced and those who have had to cut back or stop regular savings. If this divide in savings patterns continues for any length of time, it will have a big impact on the future financial security of different groups.

“For those fortunate enough to have continued in employment, there’s been a positive impact on saving. With less money being spent on the daily commute, leisure activities and eating out, our research finds many have taken the opportunity to increase their monthly savings by an average of £197.

“But in sharp contrast, the self employed and those employees who have been furloughed are the groups most likely to have reduced or stopped savings. Hopefully, the cuts in income these groups are suffering will be relatively short lived and they will be soon be able to resume saving for their futures.

“In these uncertain times, many have no option but to focus on today’s challenges. But where possible, putting more aside into savings can help people build up greater financial security for their futures. Before making any major changes to savings, it often pays to seek financial advice.”

|