In the past some investors sought to live in retirement purely off the ‘natural’ yield from their investments – dividends from shares, coupons on bonds and interest payments on savings – without touching their capital. But the new Royal London research – ‘Don’t chase risky income in retirement’ – shows that in an era of low interest rates, very few types of investment now generate enough ‘natural’ yield to support the need for income in retirement.

The paper makes three key points:

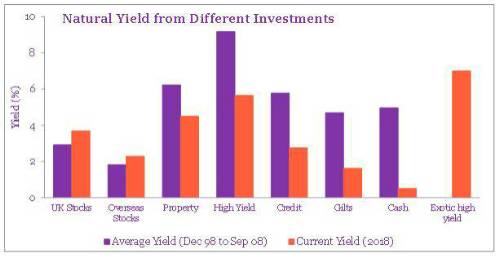

Chasing high natural yields in a low return environment almost inevitably involves taking a large risk with capital. It also leaves investors with a poorly diversified portfolio which exposes them to considerable volatility during periods of market stress. The Figure below (drawn from the paper) shows the sort of natural yields offered by various asset classes in the decade before the financial crash and the sort of yields that they generate today. Those seeking an adequate level of natural yield are now driven towards ‘exotic high yield’ investments like peer to peer lending and aircraft leasing, whereas a much broader range of traditional investments used to generate a decent regular income;

Going to the other extreme of being ultra-cautious in retirement will generate very poor levels of retirement income, especially because of low interest rates and increasing longevity, and could increase the likelihood of the pension pot running dry too soon

That focusing on getting the risk level right by investing across a range of asset classes that generate both income and capital growth helps to overcome both of these problems; multi-asset investing is more diversified and therefore reduces volatility, and seeking both income and capital growth opens up a much wider range of potential investments; rather than living purely off ‘natural yield’, the paper recommends that individuals reinvest dividends, coupons and interest payments back into their fund and generate an income by selling units of capital each year to live off;

Commenting, Trevor Greetham, Head of Multi-Asset at Royal London Asset Management said: ‘The strategy of hoping to generate enough income in retirement from the natural yield on investments may have worked before the financial crisis but is highly risky in today’s low interest rate environment. Savers need to realise that chasing after high yielding investments today can involve investing in an unhealthily narrow range of assets that could suffer large capital losses as interest rates rise. Our research shows that it is possible to have a good standard of living in retirement by investing across a risk-controlled mix of assets, targeting both income and capital growth. Investment conditions today are a world apart from those before the financial crash, and retirement investment strategies need to change accordingly’.

|