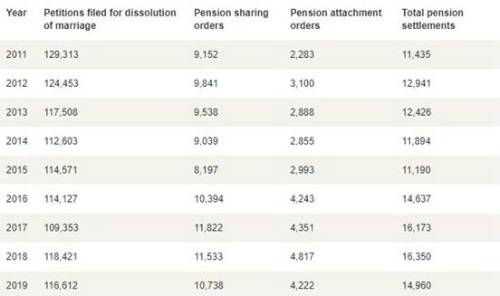

Quilter’s analysis the most up to date Family Law Court statistics with pension statistics included show there were 116,612 petitions filed for dissolution of marriage in 2019, but only 13% contained some sort of pension settlement order. This is despite a recent trend in people getting divorced later in life. According to the Office for National Statistics, over the last two decades the average age for someone to get divorced has risen eight years for both men and women with the average sitting at 46.4 for men and 43.9 for women.

As people divorce later, this group have less time to build a retirement income if they did not have a pension of their own, meaning dividing this asset is of vital importance to avoid pension poverty.

Although ‘DIY divorces’ were already possible before the introduction of no-fault divorces, the new legislation makes it easier for couples to apply for divorce without needing to apportion blame and can deal with the paperwork more easily themselves.

When couples divorce they have different options for how they divide assets between them, including pensions. The primary methods used for pensions are:

Offsetting, where the pension assets can be offset against other assets of the divorcing parties.

Pension sharing orders, where pension assets are divided at the time of divorce and there is a clean financial break.

Pensions attachments orders, also known as pension earmarking, where the pension provider of one party pays an agreed amount direct to the former spouse when the pension rights come into payment. This does not represent a clean financial break between the couple and risks the loss of future income for the former spouse if the person with the pension rights dies before retiring or the former spouse remarries.

Since 2015 the use of pension attachment orders has increased by 41%, while pension sharing orders have risen by 31%. However, while both types of pension orders have increased in popularity, they still represent a relatively small percentage of total divorce cases.

Jon Greer, Head of Retirement Policy at Quilter, comments: “The breakdown of a relationship is not an easy time for anyone and the change in law to allow no fault divorces allows couples who are amicably separating to not have to apportion blame. This brings divorce into the 21st century and is definitely a good step forward. However, it does open the door to more couples doing their divorce themselves as the solicitors become less integral to the process.

“This in turn could mean that couples when considering how they split their money forget to include their respective pensions. This can be particularly problematic given the average age of divorcees and on average this may impact women more typically have smaller pension pots.

“The low number of pension settlements may be due to a lack of understanding or knowledge in this complex area by divorce practitioners and their clients. It could also be down to more people choosing to go down the pension offsetting route. For example, one spouse may want to stay in the marital home in lieu of receiving part of their ex-spouse’s pension rights.

“Divorcees and particularly those choosing to do a DIY divorce must carefully consider how to split pension wealth or may miss out on important pension benefits. It is always worth getting professional advice, both legal and financial, before, during and after any divorce case to ensure any settlement is fair for all parties involved.”

|