Retirees seeking the security of a guaranteed income for life are being reminded to shop around for the best deal after new analysis revealed the least competitive deals are paying older buyers less than those five years younger.

Although annuities typically pay older retirees more than younger retirees due to them having fewer years of life remaining, analysis of recent market rates by retirement specialist Just Group found that in some cases people are being offered lower rates than are available to those five years younger.

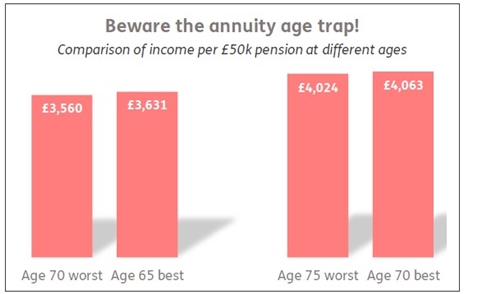

A 70-year-old with a £50,000 pension fund would receive £3,560 a year from the least competitive deal, which is £71 a year less than the current best deal on offer to a 65-year-old. The worst deal for a 75-year-old is £4,024 which is £39 a year less than the best deal for a 70-year-old.

“Our research reinforces the importance of retirees shopping around for the best rate when buying a guaranteed income for life,” said Stephen Lowe, group communications director at the retirement specialist Just Group.

“You may have saved with your current pension provider for years but that is no guarantee that they will offer you a competitive rate. In some cases, retirees are being offered rates that deliver less income than people five years younger can secure.

“Annuities give people peace of mind to spend what they receive without worrying it will run out during their lifetime. But you have to get the choice right first time – finding the deal that will deliver the best income. That means shopping around and disclosing health and lifestyle information that could push up the rate.”

He said all retirees should take the free, independent and impartial guidance from the government-backed Pension Wise service. Professional annuity brokers or financial advisers can help retirees choose options and scour the market for the best deal.

|