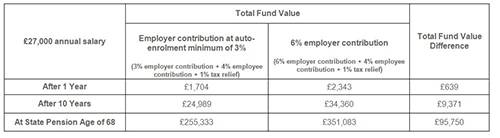

Aegon analysis shows that a 30 year old on an average salary and receiving the statutory minimum employer pension contribution of 3% could be almost £100k worse off at state pension age compared to an employee of the same age and salary with a 6% employer contribution.

Research from Aegon found that over two thirds (69%) of private sector employers contribute above the statutory minimum to their company pension scheme.

29% of employers surveyed also said they use the pension as part of their benefits package to attract new staff.

For those in the public sector, where Defined Benefit (DB) schemes are more prevalent, the value of the employer contribution can be even more significant as average contribution into a DB scheme is more than 5 times the average for defined contribution (DC) schemes.

Aegon analysis shows that a 30 year old employee on an average salary of £27K receiving the statutory minimum employer contribution of 3% could be £95,750 worse off at state pension age (68 years old) compared to employee of the same age and on the same salary with a 6% employer contribution. This assumes earnings increase at 2% a year and investment growth on the funds of 4.25% a year after charges*. In both cases we assume the employee contribution is the same, the auto enrolment level of 4% which benefits from government tax relief of 1%.

As the table below highlights, paying the auto-enrolment minimum** employer and employee contributions are not likely to produce a generous retirement fund. However both employees and their employers can choose to contribute more than the minimum levels.

Research conducted by Aegon highlighted that nearly half (45%) of private sector employers contribute slightly above the statutory minimum to some or all eligible employees’ pensions, a quarter (24%) contribute well above and just under a third (31%) contribute the statutory minimum required by law.

The research also showed that 29% of private sector employers use their workplace pension as part of the benefits package to attract new staff.

Latest figures from the Occupational Pensions Schemes Survey (OPSS)**** show average contributions to Defined Benefit (DB) schemes in 2018 were 25.6%, more than 5 times the average to Defined Contribution (DC) schemes. With the majority of active members in DB schemes in the public sector (6.3 m of the total 7.5m), the employer contribution carries an even greater value for these employees.

Steven Cameron, Pensions Director at Aegon, comments: “Considering your pension may not be top of the list when changing jobs but the value of employer contributions should not be underestimated. Many employees are unaware of the ‘free money’ in the form of employer contributions that is added to their workplace pension and how significant the differences between an employer who pays the minimum and one who goes above and beyond will be. Our figures show that by the time someone reaches retirement, the value of a higher employer pension contribution of 6% rather than 3% could be equivalent to more than three years of initial salary.

“Individuals considering job offers should make sure they find out how much the employer contributes to the company pension and also if they offer ‘contribution matching’ - whereby the employer will pay more into the pension scheme if the employee increases their contribution. The consequence of overlooking this can be significant and could mean missing out on thousands of pounds by the time you reach retirement age.

“Some employers promote their more generous pension scheme rather than headline salary as a means to attract new staff. It’s important job changers take this into account as a higher salary isn’t necessarily better if it comes with a lower pension contribution.

“For those looking to move between public and private sector jobs, this can be even more severe as public sector pensions often have considerably higher employer contributions.”

|