|

|

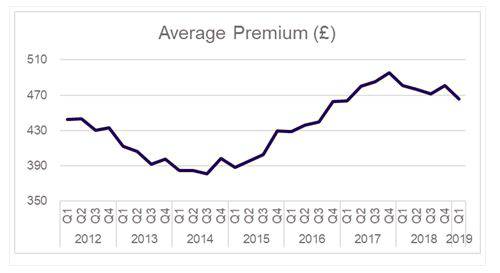

Downhill drive – large quarterly drop sees the cost of motor insurance fall to a two-year low |

The average cost of motor insurance has fallen to its lowest level for two years - £466 - according to the ABI’s latest Motor Insurance Premium Tracker out today. The Tracker is the only survey that looks at the price consumers pay for their cover, rather than prices quoted.  Today’s figures reveal that:

The average price paid for motor insurance in the first quarter of the year was £466, the lowest quarterly figure since Q1, 2017.

The average premium fell by £15 on the previous quarter and was the largest quarter on quarter fall since 2013. This was the fourth consecutive quarter year- on-year premium decrease.

Reasons for this significant fall are likely to be some insurers passing on expected cost savings in anticipation of the reforms of the Civil Liability Act, which will deliver a fairer compensation system for claimants, and continued competitive premiums for motorists. Also, new vehicle registrations in March saw a rise in new cars purchased, typically by more mature, lower risk drivers.

Mark Shepherd, ABI’s Assistant Director, Head of General Insurance Policy, said: “The falling cost of motor insurance is great news for motorists after several years of rising premiums, which largely reflected the UK’s costly personal injury compensation system. As the industry promised, motorists are now beginning to see the benefits of the personal injury reforms recently enacted. “However, some cost pressures remain, with rising repair costs, and the Government needing to resist any temptation to further increase Insurance Premium Tax. So motorists should continue to make the most from a competitive market by shopping around for the best deal for their needs.” |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.