Survey evidence suggests that a small but growing proportion of people are choosing not to save for their retirement through a pension. Instead, they plan to ‘downsize’ to a smaller property, and to use the proceeds to fund their later life. But the latest Royal London policy paper: “The Downsizing Delusion” shows that for the vast majority of people, this strategy is likely to lead to a slump in their standard of living when they stop work.

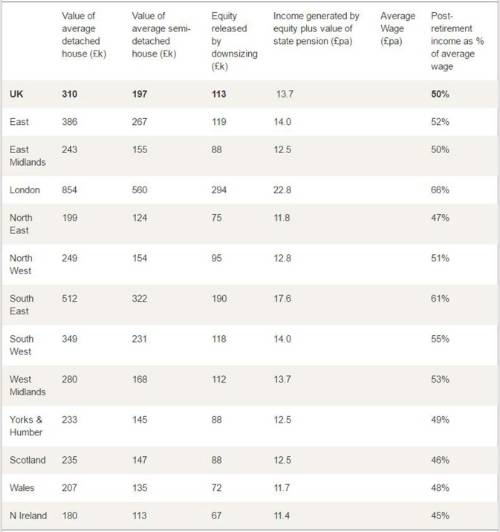

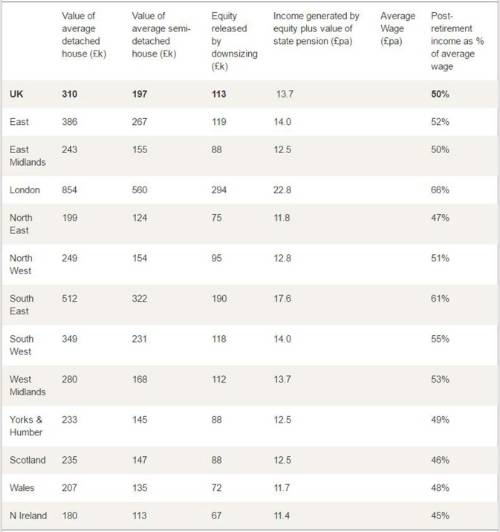

The report shows that, looking across the UK as a whole, the average person downsizing from an average detached house (worth £310,000) to an average semi-detached house (worth £197,000) and using the proceeds to buy an annuity would secure an annual income (from annuity plus state pension) of £13,700. But the typical UK full-time worker has an annual wage of £27,400. This means their income would slump by half on retirement.

Table 1 sets out the results for the UK, for each nation and for each English region.

The report also highlights a number of barriers to a ‘downsizing’ strategy:

-

‘the nest may not be empty’ – current generations of workers had children at later ages than previous generations and those children are staying at home for longer until they can buy a first home; downsizing may be difficult if the ‘spare bedroom’ is not spare;

-

‘you may still be paying your mortgage’ – one in three mortgages now lasts to age 65 or beyond, and of these, one in three is to a first-time buyer; growing numbers of people will still need income to service a mortgage beyond traditional retirement ages;

-

‘your planned retirement date may coincide with a period of low house prices’ – house prices go through periods of boom and bust; if your planned retirement date is after a house price fall, you may have to defer your retirement; with other investments it is easier to smooth the ups and downs of the economic cycle;

-

‘there may be nothing to downsize to’ – in rural areas in particular, finding a suitable property which does not mean people have to move away from friends and social networks may be impossible;

-

‘you may not want to downsize’ – if you have invested heavily in your family home, you may not want to move out of it to a far smaller property just at the point when you would be spending more time in it; survey evidence suggests that out of larger family homes that are freed up by those over pension age, five out of six are released because of the death of the owner – only a tiny minority are freely downsized;

Table 1. Estimates for the UK, nations and English regions of potential income from downsizing as percentage of pre-retirement wage

Commenting, Steve Webb, Director of Policy at Royal London said: “Hoping to live off the value of your home could be a ‘downsizing delusion’ for millions of people. In most of Britain, the amount of money you could free up by trading down at retirement to a smaller property would generate a very modest income. Someone who chose to save for later life through their home rather than through a pension could easily see their income halve at retirement. If they opt out of workplace pension saving they are also missing out on tax relief on pension contributions and a valuable contribution from their employer. Even with today’s record house prices, very few people could fund a retirement by selling up and moving to a smaller property. In addition, house prices can be volatile, not least in the light of the recent Brexit vote, and depending on the value of a single asset – your home – to fund your whole retirement is an incredibly risky strategy.”

|